Rami Deeb, marketing manager, Talkwalker, a consumer intelligence company, gives insights into customers in the GCC after Talkwalker’s latest report, ‘Evolving consumer behaviour in the GCC during Ramadan 2022’, which reveals the shifts in consumer preferences, priorities, and behaviour towards CPG brands during the past Ramadan season. Deeb gives further details on the report and how brands can leverage their strategies to target the average customer in the GCC.

How can brands better understand a consumer segment?

It is critical for brands to understand that the idea of a ‘consumer segment’ has evolved during the pandemic. Consumer categorization can no longer be confined to metrics like purchase history, income level, or even geography.

The pandemic has made the gap between brands and consumers even more acute. It highlighted the disjuncture between what consumers really need and what brands assume they want. This modus operandi no longer applies, especially in a dynamic market such as the GCC.

Therefore, in order to understand a consumer segment, brands must embrace a new analysis model built on a consumer-close approach – giving them the flexibility to leverage big picture metrics as well as granular ones such as sentiment and intent.

Are you doing video right? And do you want to do it better? Join us at our next Campaign Breakfast Briefing: Video 2022 – Moving Pictures to discover the latest learnings from platforms, broadcasters and other industry experts. There will be insights; there will be original research. The only thing that will make this event better is you. Join us and the industry on the 27 May.

Having a consumer-close strategy requires the implementation of consumer-close data, technology and talent. Meaning, that the entire organization must be able to connect the dots to understand the context. The more dimensions data has, the faster it becomes to reach an insight and to act upon it.

One key element that accelerates consumer closeness is artificial intelligence and predictive analytics. Specifically, predictive analytics that’s capable of not only making projections based on historic data but also offering actionable strategies in a conversational and approachable manner. Think of it this way, both an intern and a C-level executive should be able to leverage predictive analytics. Data democratization across an organization will prove to be a major competitive advantage for brands.

To reiterate, brands must not prioritize profiling consumer segments, instead, they need to lay the foundations to be able to swiftly adapt to consumers’ changing needs, preferences, and priorities in the future.

Can you share a pattern of the preferences switch of customers after the pandemic?

One key pattern we observed from the report is that GCC consumers are more price-sensitive than before the pandemic. This Ramadan there have been over 10K online conversations emanating from the GCC region that relate to ‘Ramadan discounts’. This data combined with the survey show that consumers in the GCC are not immune to globally increasing prices. Interestingly, the consumers of all age groups and income levels have shown the same priority when comparing brands.

Is Ramadan the biggest time for brands in the Middle East?

Ramadan poses a tremendous challenge for brands, while also revealing unforeseen opportunities. Historically speaking, Ramadan is a celebration where most brands spend large sums of money on TV advertising and digital marketing campaigns. Whether those activities lead to increased sales is dependent on how consumers react to them. As a result, in order for brands to seize the Ramadan opportunity they must innovate and adapt to consumers’ lifestyles within the month – advertising and marketing campaigns can’t be set ahead of time and be expected to work like magic.

The main challenges facing brands during Ramadan lie in consumers’ unpredictable behaviour before, during, and after the holy month. Consumers generally have a different work schedule, their sleeping pattern shifts according to suhour and iftar times, and are often less susceptible to being convinced by an ad. The study reveals that consumers are more likely to buy from the same brand based on the quality to price ratio, past experience with the brand, and the ability to trust the brand. It’s not impossible for brands to deliver on those promises – all that consumers want is a consistent and enjoyable experience with the product they have long considered reliable and effective.

As for the opportunities during Ramadan, it is important for brands to understand that Ramadan is not simply a 30-day time period that culminates in Eid and a sense of joy among consumers. Ramadan provides an annual opportunity for brands to get closer to their consumer base by adopting a relatable and approachable voice. Of course, all this is implemented based on the data and is continuously improved with time.

How loyal are customers in the GCC in comparison to other regions?

According to a recent survey conducted in partnership with YouGov MENA we have observed that 72% of GCC consumers plan to continue buying brands they have purchased in the past, which reflects high brand loyalty. We also conducted the same survey in Turkey where 71% consumers shared the same sentiment of GCC consumers.

This might indicate that brand loyalty is high among GCC and Turkish consumers, however when asked about buying quality products regardless of the brand, both regions have high rates saying they agree: 69% and 70% respectively. Meaning, if consumers are faced with two unbranded products, they are more likely to choose whichever one they perceive as having higher quality.

What is one of the best strategies that marketers can use during Ramadan?

It really depends on each brand and how it aims to connect with consumers as well as what goals it hopes to achieve. Though, there’s a general framework that might be helpful for marketers aiming to engage consumers during Ramadan.

By having a forward-looking strategy, marketers can overcome obstacles at a much faster pace, as well as gain an unforeseen competitive advantage over their competitors.

The framework is fairly simple and effective:

- Connect with your consumer base on a human level: Being able to stand out from the crowd and to connect with the audience requires that marketers use the same tone and language consumers use. Plus, marketers must have their finger on the pulse of consumers in order to be empathetic towards their sentiment and intent. Ramadan is the time to show your brand’s human side.

- Use real-time data to your advantage: It is always important to remember that the main purpose of consumer data is to guide and direct marketers into opportunities, rather than confuse them. Keep your data reporting simple enough to be able to extract actionable insights, while also being robust enough to better analyze and predict trends before they happen.

- Create value at every touchpoint: Marketers often consider themselves outside of the sales cycle, however, since the pandemic the lines between sales and marketing are increasingly blurred. Whether it’s entertainment, better customer service, a useful piece of information – consumers want value in all shapes and forms.

- Have fun and try out new things – this one is pretty straightforward.

How is the average consumer in the GCC?

One thing to clarify is that the average consumer must not be understood as the consumer who is simply part of the general public. The average consumer for one brand that offers a particular product or service might be entirely different than that of another brand. This structure also applies when a product is purchased by uninformed consumers who are part of the general public.

In the GCC, the average consumer is well-informed about the ongoing changes affecting their purchasing habits. This is reflected by consumers saying they consider the price to be the primary factor when comparing brands. Also, the average consumer is observant and keen on fulfilling its needs within an enjoyable customer experience.

What is one of the most important factors that would make a customer from the GCC choose a brand over another?

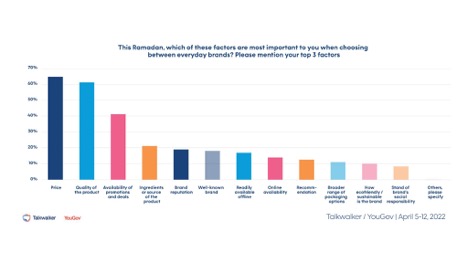

After surveying a sample of over 2700 consumers from the GCC, we can assume that consumers are price-conscious. When asked to choose the top three factors they consider when choosing between brands, the majority said: Price (66%), Quality (61%), and Availability of promotions and deals (42%).

GCC consumers prioritize the price, quality, and deals when comparing brands

What type of products are most in demand in the GCC region?

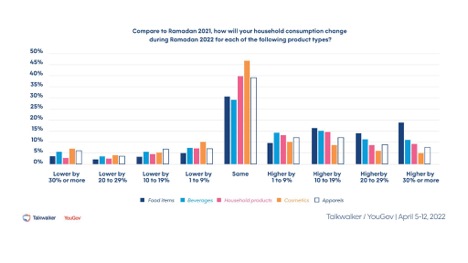

Generally speaking, GCC consumers have said that they planned on buying the same amount of CPG products during Ramadan 2022 compared to the previous year. However, the main category that sees high intent of buying more is food. Almost 20% of the respondents have said they plan on buying 30% or more food in Ramadan 2022 compared to last year.

GCC consumers plan to consume the same amount of CPG products during Ramadan 2022 compared to last year

How can brands create loyalty and trust in GCC customers?

Consumers often trust brands that are empathetic, transparent, and consistently reliable. Think of it this way, would you trust a stranger you bumped into on the street? Of course not, and the same thing applies to the consumer-brand relationship.

Brands must consider every touchpoint with the consumer as an opportunity to solidify their position in the marketplace and in the consumer’s mind. In order to maximize brand loyalty and trust among GCC consumers, brands must be able to provide value and to anticipate the changing needs of consumers. For now, price appears to be what consumers value, however, in the future things might change and consumers might prioritize convenience for example.

The point is that brands must be able to observe the nuances among various consumer ‘segments’, but not fall into the trap of generalizing. Each consumer has a unique and particular relationship with the brand, and it is the brand’s top priority to turn that relationship into a lifelong commitment built on trust and open communication.