Among the different categories, consumers are most likely to try this solution for clothing and technology.

Covid-19 and the governmental response has affected shopping behaviour globally, making it crucial for retailers and brands to understand the dynamics impacting shoppers within the retail industry.

YouGov’s latest report titled ‘International Omni-Channel Retail Report 2021: Shopping in the pandemic and implications for the future’ provides an overview of the impact of Covid-19 on shopping attitudes and behaviours across 17 global markets.

Smart thinking and new technologies have taught the established medium of television some new tricks. Find out how to grab viewers’ attention at our Campaign Online Briefing – TV 2021: Changing Channels

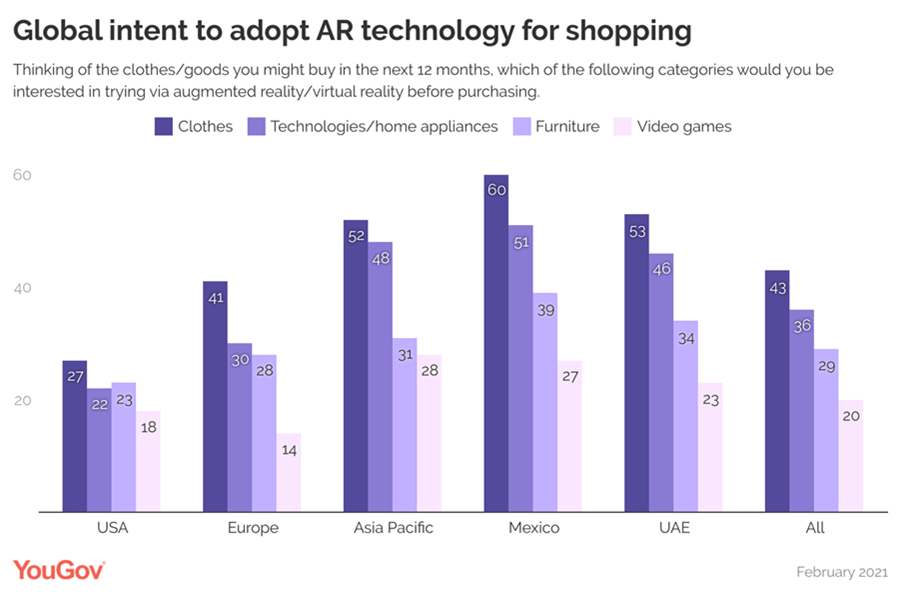

Data from the whitepaper shows when asked how consumers felt about augmented or virtual reality for the purpose of shopping, less than 50% of consumers globally claimed interest in using this technology for any shopping category specifically.

Although interest is nascent across the globe, it varies by category. Consumers showed the most interest in using these solutions for clothes and technology.

Amongst the 17 surveyed markets, interest to adopt virtual or augmented reality is higher in Asia, the UAE, and Mexico compared to Western Europe and the US.

While interest across categories is the highest in Mexico, large proportions in the UAE are likely to shop for clothes (53%) and technology or home appliances (46%) in the next 12 months using virtual reality tools.

Looking at the general shopping habits of consumers, we found that brick-and-mortar and online channels are pervasive among shoppers around the globe, with an average penetration of 86% and 81%, respectively. Most consumers across the globe shop through both retail channels, with nearly three-quarters (74%), having made purchases through both channels in the past three months.

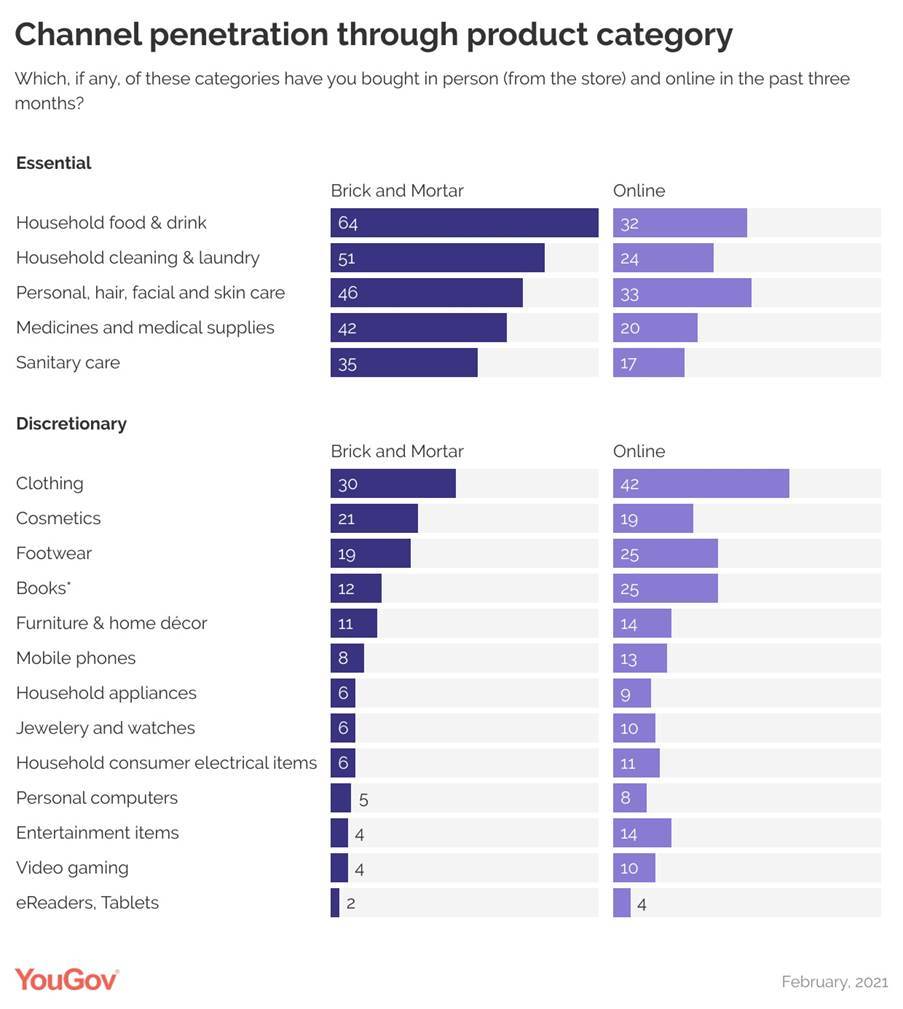

While both channels are well penetrated, the category of purchase varies. Brick-and-mortar continues to be the go-to method for purchasing everyday essential items such as food, drinks, toiletries and more. Conversely, online retail channels are the preferred channel for discretionary items such as shoes, clothing, and electronics.

The recent Covid19 pandemic has changed shopping behaviour, shifting many shoppers online to meet their needs. Despite the shift, many still want to buy through brick-and-mortar outlets. This is especially true for certain categories like clothing.

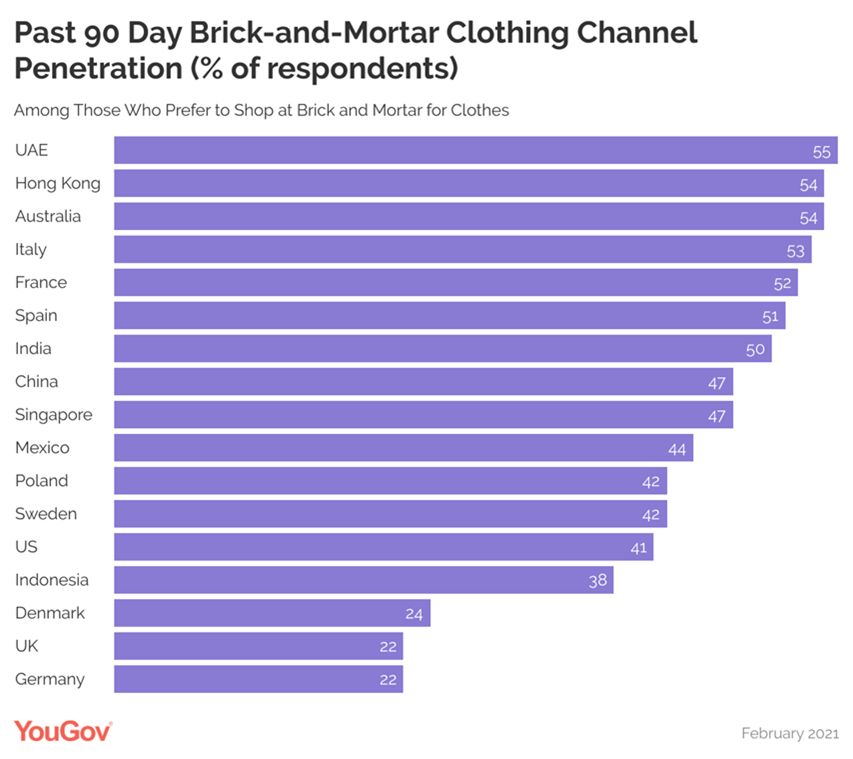

Looking at the in-store penetration in the past 90 days, we see that the UAE has the highest proportion of people who in general have a preference to shop clothes at brick-and-mortar stores buying from these stores during this time (55%).

When it comes to motivations, the physical experience of a product is the biggest factor in wanting to shop at an offline store, followed by speed of purchase and the provision to try out things in store. While this is good news for retailers, it does not help much under the current restrictions and social distancing norms that dissuade them from shopping in person.

On the other hand, online retailers have benefited in the short term by addressing the challenges shoppers face in buying goods while also adhering to social distance restrictions. Home delivery is the number one motivational factor to buy online, followed by convenience. However, delivery charges and the inability to experience products stand as the biggest barriers for this medium.

Commenting on this, Adam Guiney, Director of Customer Experience at YouGov, said, “When looking at the data for the white paper, it was striking to see that despite the huge online retail boom during the pandemic, bricks and mortar retail is still more popular in many categories – for example, textiles and clothing – and therefore has a great chance of rebounding; it is just a question of when. Our study aims to help outlets and brands understand the dynamics of the retail sector, which has never been shaken as much as it has been during the past year.

Understanding consumer needs and the interplay between bricks and mortar and online retail in meeting those needs will be key for brands and retailers to identify potential, overcome barriers and focus on opportunities.”

Download the full report here.

Methodology

This paper was produced using a combination of data from a custom real-time survey with YouGov’s industry-recognized panel executed across 17 global markets, linked with the YouGov Cube, our proprietary connected data set encompassing hundreds of thousands of variables, and over a decade of data on our panel members. For this analysis, we leveraged our Real-Time survey linked to YouGov Profiles, our always-on syndicated audience profiling solution that tracks hundreds of thousands of consumer variables in over 55 markets. Our survey was fielded the week of January 11th through the week of February 22nd, 2021, with respondents reflecting on their shopping behaviours and attitudes over the previous three months.

The YouGov panel provides a naturally accurate and representative view of the population. Data is adjusted using a mild weighting team using interlocking demographic characteristics—methodology considered advanced in the market research space. For this paper, the following population representation was used:

| Market | Population Sampled Representation | Sample Size (n=) |

| US | National representative – 18 years of age + | 2,251 |

| Mexico | National (Urban focus) – 18+ | 1,069 |

| UK | National representative – 18+ | 2,113 |

| France | National representative – 18+ | 1,012 |

| Germany | National representative – 18+ | 1,014 |

| Spain | National representative – 18+ | 1,064 |

| Denmark | National representative – 18+ | 1,024 |

| Italy | National representative – 18+ | 1,015 |

| Poland | National representative – 18+ | 1,011 |

| Sweden | National representative – 18+ | 1,012 |

| Australia | National representative – 16+ | 1,031 |

| China | National Online – 16+ | 1,011 |

| Hong Kong | National Online – 18+ | 504 |

| Indonesia | National Online – 18+ | 1,018 |

| India | National Online (Urban only) – 18+ | 1,021 |

| Singapore | National representative – 18+ | 1,013 |

| UAE (United Arab Emirates) | National representative – 18+ | 1,005 |