Holding company agency groups face “below-average” growth in a post-Covid-19 landscape as clients increase the pace of digital transformation, investment bank Credit Suisse has warned.

Holding company agency groups face “below-average” growth in a post-Covid-19 landscape as clients increase the pace of digital transformation, investment bank Credit Suisse has warned.

The bank’s equity research analysts have compiled a 100-page report, Ad Agencies, Beyond the Pandemic, for which they conducted what they called a proprietary survey of about 50 industry professionals.

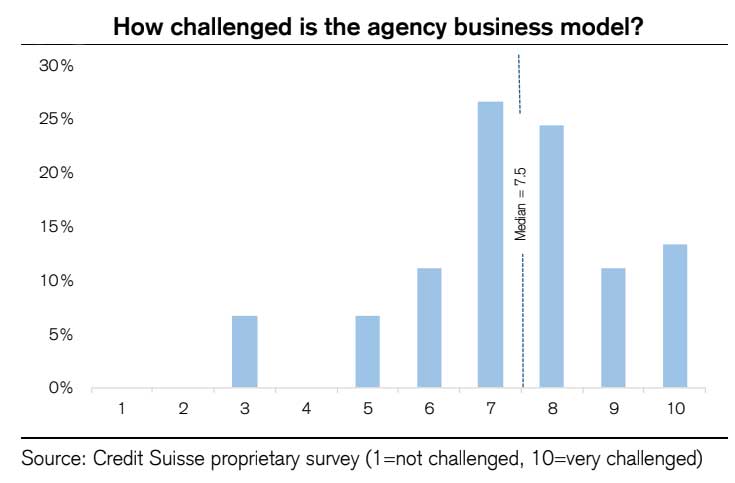

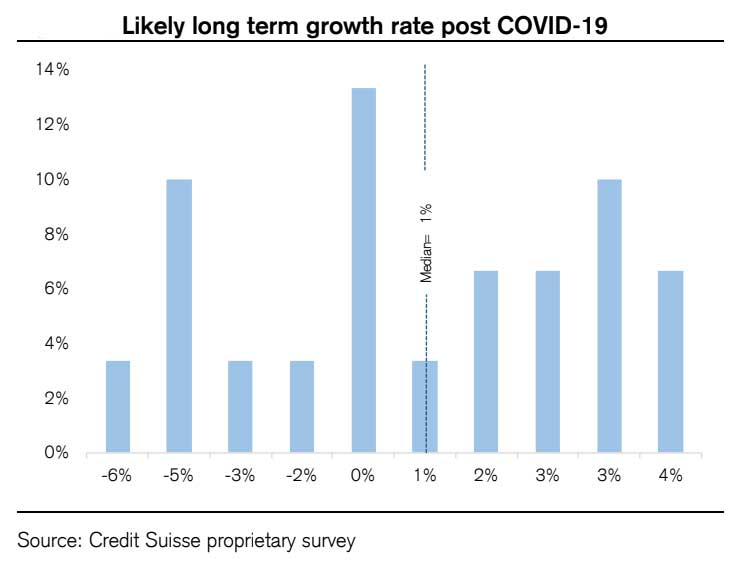

The report found that the median long-term growth rate for the sector was likely to be just 1 per cent after the coronavirus pandemic, although there was a wide divergence of views about how “challenged” the agency business is.

Describing advertising agencies as “the great survivors” that have grappled with the move to digital over the past decade, the report said the Covid-19 crisis has precipitated a sea change in consumer behaviour, particularly in e-commerce, that will increase pressure on holding companies.

Brand communications revenues (referring to traditional advertising) made up about 70 per cent of revenues for the big agency groups but were growing at less than 2 per cent to 3 per cent, prior to the coronavirus crisis, partly due to pressure on agency fees and in-housing of services by clients.

Meanwhile, agencies were only capturing single-digit growth in the booming experience, commerce and tech space, even though the sector was growing at between 5 per cent and 15 per cent, as newer players enter the market.

Management consultants have seized on the crisis as a “marketing opportunity for transformation services, such as cloud-based systems, customer experience and data analytics”, the report said.

As a result of this revenue squeeze, Credit Suisse suggested that agency profit margins were likely to suffer, particularly in media buying.

This is partly driven by Google, Facebook and Amazon continuing to take a greater share of global adspend as more media spend migrates online and some clients buy direct.

The disruption in the traditional agency sector means there is a reasonably strong likelihood of industry consolidation over the next two years, according to the report.

But there was no strong overall view on whether this would mean agencies combining with other agencies or combining with consultancies or tech companies.

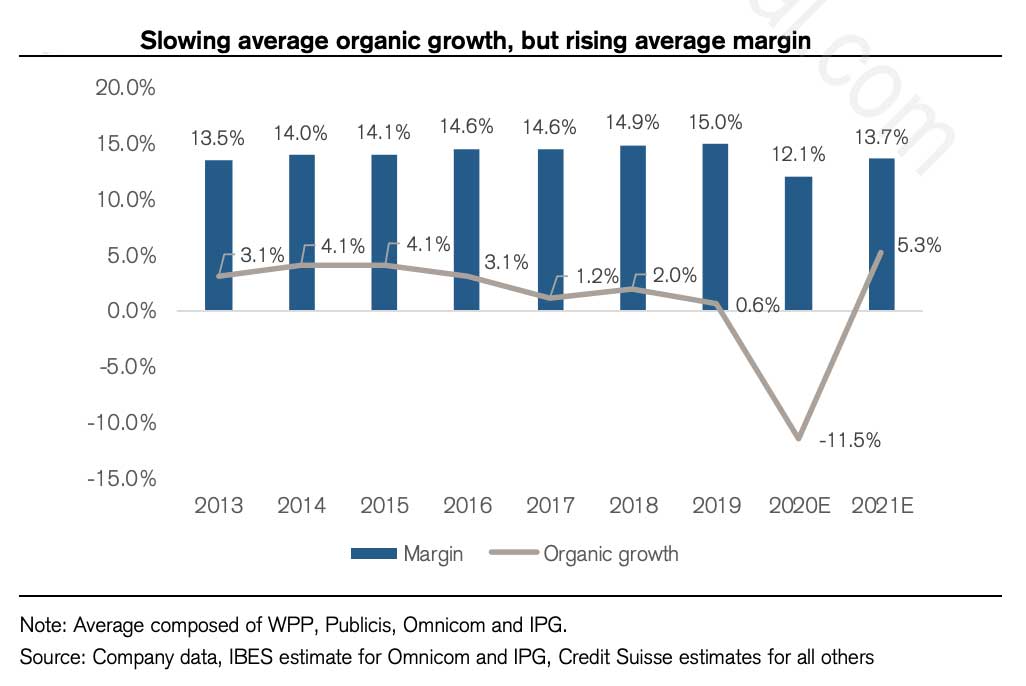

The long-term challenges facing the “big four” main holding companies, WPP, Omnicom, Publicis Groupe and Interpublic, can be seen in how annual revenue growth has fallen since 2015, the report also shows.

“This is an increasingly crowded space with strong competition,” the report warns, “not only from consultancies but also many specialist independent agencies, tech firms and marketing technology providers. This will make for a tough transition.”