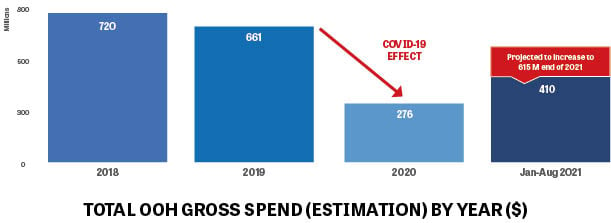

Out-of-home (OOH) is proven to be a very effective media channel. It was affected during the pandemic because people were locked down at home, but now it is back on track, especially in our region. Digital has taken share of ad spend from many media, but not from OOH. Outdoor itself is going digital.

Outdoor or OOH in the digital age has adapted the ways of both the old and the new with the use of technology via digital screens, interactive outdoor experiences, live events, non-formatted digital outdoor, special builds and more. It has been transforming for the past 10 years and is moving forward.

OOH is the form of traditional media that cannot be taken over completely by the digitalisation shift. OOH advertising will continue to stay around and work if people continue to travel and get out of their homes, whether for work, lifestyle, or leisure.

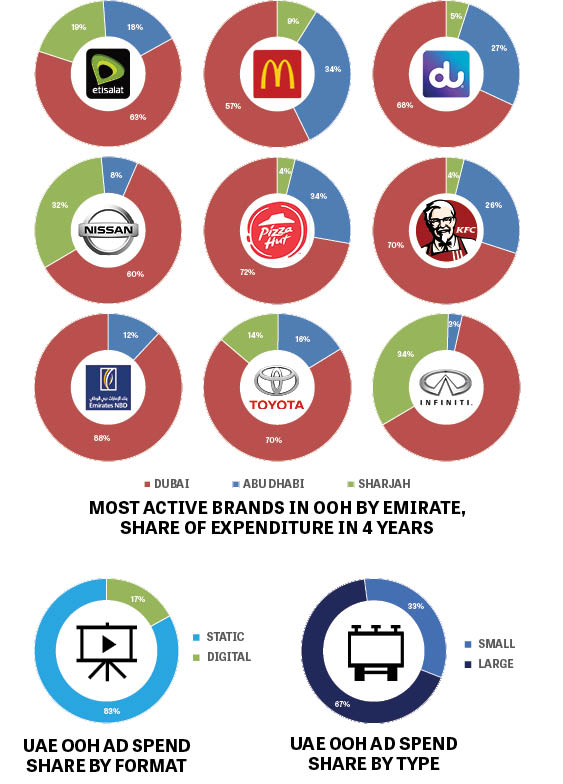

A huge part of the world echoes what is happening in the UAE, where we are going back to normal life and the economy is pulling itself back together. Traffic is going back to normal, and we have started to see all OOH locations full of ads again. OOH is the second biggest local media in UAE, but is still not fully measured, which is keeping media owners and advertisers a bit in the dark when it comes to selling or measuring the audiences of their campaigns.

OOH, measurement has become essential for advertisers to ensure their campaigns are yielding results. With the rise of digital advertising and real-time optimisation, it is no longer an option for OOH to remain free of key performance indicators (KPIs), considering spend on outdoor can take up a big part of advertising budgets.

With the ambition to create an audience measurement currency for all advertising displays, regardless of where they are located, Ipsos has covered the geography of all UAE based on points and areas of interests across streets and locations. Our interactive web-based solution, IMS (Inventory Mapping System), is used to interpret the geographic map with the application of frame and street link adjustments.

Delving into the technicalities, there are many possible data sources to collect insights and do the measurement. Each data set has an additional value but also has its limitations. Therefore, we combine various sources of data for accuracy and timeliness. Third-party data sources provide general behaviour, and this sort of data – whether it is taken from telco companies or mobile-SDK (software development kit) data – is very good for understanding macro-level activity, but it is not enough. More nuanced behaviour and movement are only understood via first-party data tracking and absolute-count sources, which are ideal for identifying micro-level activity, allowing for understanding of true volumes, frequency, and profiling of people.

By Andre Youssef, chief adex officer, Ipsos MENA