The global retail sector is in an unprecedented state of flux and as the end of the year approaches, Nielsen Global Connect predicts that holiday season spending will differ depending upon the evolving consumer groups as their shopping behaviour resets based on their spending preferences and physical restrictions.

Do you want to see the future? Sign up for Campaign’s Marcomms360 Predictions 2021 virtual event. December 14-15. Registration free

Previously, consumer confidence in Africa and Middle East region dropped to 93 in Q2 2020[1] – a seven points decline from Q4 2019. Both UAE and Saudi Arabia declined from Q4 2019 versus Q2 2020. In UAE it dropped 19 points, going from 110 to 92 points and in Saudi Arabia, it decreased from 119 points to 104. Confidence rollout is underscored by job prospects which are also facing a decline from 46% in Q4 2019 down to 39% in Q2 2020 for the region. Given these financial challenges and circumstances, the last quarter of this year holds a crucial opportunity to witness revival from consumer spending on account of the festive season.

“As the end of the year approaches, upcoming festivities are going to look very different for consumers depending on where they live, what restrictions they face and how Covid-19 has changed their spending habits. However, the reality is that the ‘golden quarter’ which is considered the crucial holiday trading period is already underway and with the continued spread of the virus and ongoing restrictions, this year’s festive period will be unlike any other,” says Andrey Dvoychenkov, Nielsen Global Connect Retail Intelligence lead for Arabian Peninsula.

Evolving consumer groups

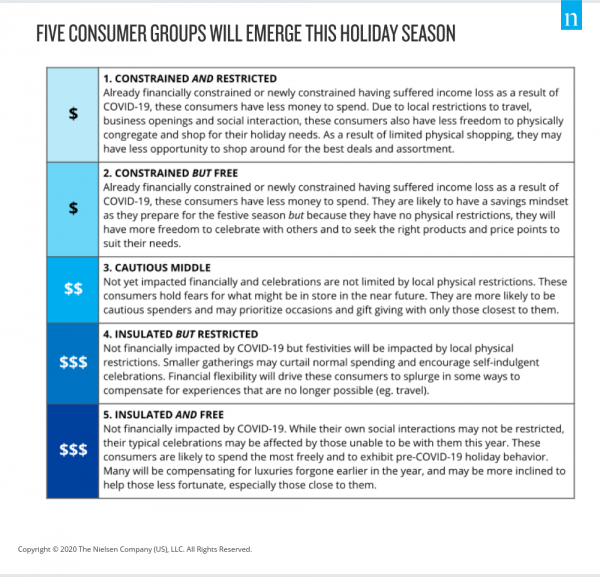

Against this backdrop Nielsen has identified five different consumer groups that indicate how financial and physical restrictions could manifest leading up to the festive season.

- Constrained and Restricted consumers have suffered income loss as a result of Covid-19 and have less money to spend and also have less freedom to physically congregate and shop for their holiday needs due to local restrictions to travel, business openings and social interaction. As a result of limited physical shopping, they may have less opportunity to shop around for the best deals and assortment.

- Constrained but Free consumers have also suffered income loss and are likely to have a savings mindset as they prepare for the festive season but because they have no physical restrictions, they will have more freedom to celebrate with others and to seek the right products and price points to suit their needs.

- Cautious Middle consumers have not yet been impacted financially and their celebrations are not limited by local physical restrictions. They are more likely to be cautious spenders and may prioritise occasions and gift-giving with only those closest to them.

- Insulated but Restricted consumers have not been financially impacted by Covid-19 but festivities will be impacted by local physical restrictions. Smaller gatherings may curtail normal spending and encourage self-indulgent celebrations. Financial flexibility will drive these consumers to splurge in some ways to compensate for experiences that are no longer possible (e.g. travel).

- Insulated and Free consumers have also not been financially impacted by Covid-19. While their social interactions may not be restricted, their typical celebrations may be affected by those unable to be with them this year. These consumers are likely to spend the freest and to exhibit pre-Covid-19 holiday behaviour.

In Africa and the Middle East, 76% of constrained consumers opt for Omni shopping while insulated consumers are at 73%. Additionally, 43% of constrained consumers actively look for prices and promotions in-store while 51% seek online. While when it comes to insulated consumers, 44% seek for prices and promotions in-store and 49% search online. When it comes to physical shopping, we see sharp declines with 26% of insulated consumers and 24% of constrained consumers[2]. Covid-19-driven online shopping and purchasing behaviours will become ingrained among consumers who opt to avoid regular travel (to stores), and frequent physical touchpoints. For constrained consumers, online channels serve a broader purpose: They are an essential way to research, compare prices and hunt for the right deals before deciding whether to leave home to make the purchase at a physical store or buy it online.

New purchase behaviours

To help chart the behaviour of these consumers, Nielsen has also identified four emerging patterns to help predict the drivers of pandemic purchase decisions in future. When applied to the context of the many upcoming holidays and year-end festivities, these reset patterns now highlight some important new behaviours that could emerge this season.

- Basket Reset – Holiday spending and gifting will be refined based on what and who are considered essential for each consumer. This will require retailers and manufacturers to redefine what’s festive and capitalise on the broadened assortment of what consumers might consider “giftable” this year. From a necessity that can no longer fit the budget, to a product that has been harder to get in stores this year, there will be big shifts in what defines a “gift”.

- Homebody Reset – Gatherings will be smaller and more intimate with many planned at the last minute. This might see the introduction of so-called ‘Single-Serve Celebrations that cater to needs for convenience, health and budget consciousness by offering serving sizes and packages conducive to small or socially distanced gatherings. This type of behaviour has grown in Africa and the Middle East after the pandemic with 57% working from home, 50% cleaning their houses, 48% engaging in cooking or baking, 38% enjoying online entertainment and 28% shopping online[3].

- Rationale Reset – Consumers will spend more on themselves, prioritising self-care this year. Retailers might then look to engage with empathy and recognize the trade-offs consumers will need to make. There is also scope for just-in-case solutions that cater to consumers who may be waiting to see whether they are able to physically celebrate a festive occasion or not. In Africa and the Middle East, we are seeing that consumers are rebalancing their wallet priorities with a rise of 5% between Q4 2019 and Q2 2020 from 74% to 79%. Consumers in the region spend less on clothes (46%), takeaways (43%) and out of home entertainment (37%) while there’s an increased focus on savings and paying off debt[4].

- Affordability Reset – Online shopping will power more holiday consumer behaviours than ever before creating a need to convert impulsivity. With limited physical touchpoints with consumers, it’ll be vital to create spontaneity, even in an online environment. Nielsen’s ‘the new normal’ survey suggests that consumers in Africa and the Middle East have increased their last online shopping frequency by 10 more check-outs (18 check-outs in Q2 2020 vs 8 check-outs in Q4 2019 ) in comparison to their online-shopping frequency before the pandemic. Similarly, trips to convenience stores have risen from 2 visits before the pandemic to 6 trips in the latest period.

Within this new festive framework Dvoychenkov points out, “It’s clear that celebrations are going to look very different for many consumers depending on where they live, what restrictions they face and how Covid-19 has impacted their purchasing power. Despite the diverse global spectrum of holiday celebrations, Covid-19 has forced many consumers to re-think their holiday plans in similar ways, based upon known levels of virus-related constraints and this will have far-reaching consequences for both brands and retailers.”

[1] CCI – Consumer Confidence Index by The Conference Board Global Consumer Confidence Survey conducted in collaboration with Nielsen, Q2 2020

[2] Nielsen’s Global Survey “The New Normal”, May 2020

[3] Nielsen’s Global Survey “The New Normal”, May 2020

[4] The Conference Board® Global Consumer Confidence Survey conducted in collaboration with Nielsen Q4 2019 vs Q2 2020