By Suzi Kuban, Marketing Manager at PiWheel

This year the Holy Month of Ramadan arrived in the middle of the COVID-19 pandemic restrictions. While publicly, we noticed that the heart of Ramadan – being gratitude, community, and spirituality, remained untouched; many of the usual ‘Ramadan activities’ changed. Namely the absence of extravagant iftars, mall shopping sprees and big gatherings. What did this impact have on consumer consumption?

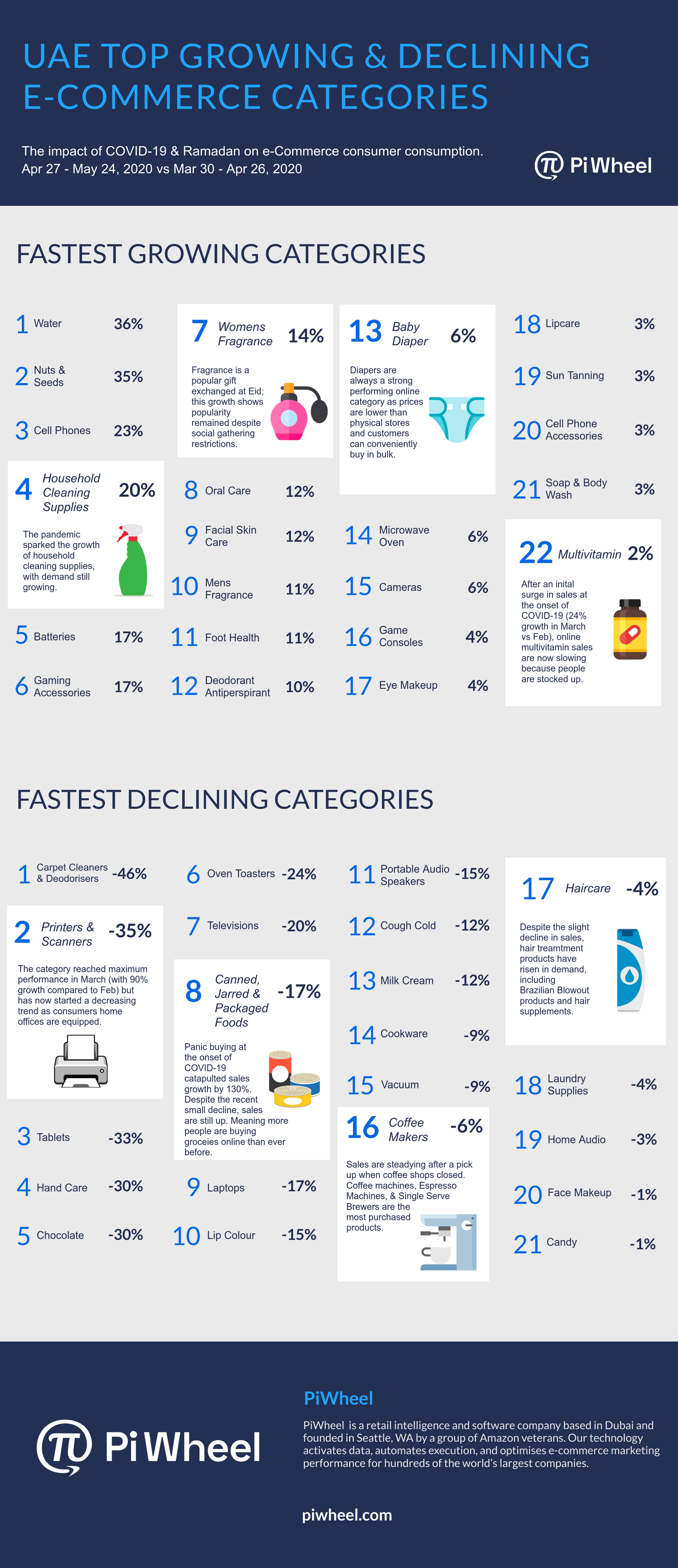

We reviewed e-Commerce sales across the UAE and compiled a list of top Growing and Declining categories during Ramadan, compared to the prior period.

The top 5 growth categories are Water, Nuts & Seeds, Cell Phones, Household Cleaning and Batteries. Water is the best performing category, with 36% growth. With online prices lower than brick and mortar stores, plus the convenience of home delivery – we expect consumers to continue purchasing water online, way into the future. Cell phones are always a top-performing e-Commerce category, and Ramadan did not stop it from growing in sales- increasing by a further 23%.

The top 5 declining categories are carpet cleaners and deodorisers, printers and scanners, tablets, hand care and chocolate. In March the carpet cleaner and deodoriser category reached a peak in sales. But since these products are not single or daily use, we see a natural decline in sales – dropping by 46% during Ramadan. Chocolates are an interesting category featured on the declining list, dropping by 30%. As a result of banned mass gatherings during Ramadan, we saw some category shifts away from what we would usually expect – e.g. chocolates, typically exchanged during these gatherings fell rather than picking up.

Other key takeaways:

- Online shopping has increased by 35% during the last three months, as consumers started to rely on retailers like Amazon for their daily needs. This trend is continuing, which is why we still see growth in categories such as water, cleaning supplies and oral care.

- Family gift exchanges for Eid appear to have still been a part of this year’s celebrations – seen in the online sales growth for men’s fragrances (+11%), women’s fragrances (+14%), and various consumer electronics (e.g. game consoles +4%).

- At the start of coronavirus restrictions in March, online sales for office equipment and home entertainment increased – for example Laptop sales rose by 29% in March, and TV sales went up by 63% during the same period. Now homes are fully equipped, sales are naturally steadying, resulting in categories such as laptops (-17%), printers and scanners (-35%), TVs (-20%) and home audio (-3%) to decrease in sales.

Observing the Holy Month, this year has been a very different experience, which the e-Commerce growth numbers show. Consumers have shifted their behaviours due to finance and health worries; buying groceries online rather than non-essential bigger ticket items, such as tablets (which dropped in sales by 33%). In the long term, e-Commerce will continue to benefit from our lifestyle changes – as it proofs to be more convenient and price competitive. To capitalise off this demand, brands will need to develop a robust e-Commerce strategy that focuses on product availability, content development and exceptional customer service.