With our access to real-time traveller audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds. In this blog series, we’ll take a look at the data in order to aid travel marketers in their assessment of this worldwide event. They can use these trends to inform their marketing strategies during this period, as the industry stabilises.

With our access to real-time traveller audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds. In this blog series, we’ll take a look at the data in order to aid travel marketers in their assessment of this worldwide event. They can use these trends to inform their marketing strategies during this period, as the industry stabilises.

These insights are based on data collected on the 12th of January, 2021. We are reviewing our data on a regular basis in order to provide an accurate view of trends and patterns in consumer behaviour. Sojern’s insights are based on over 350 million traveller profiles and billions of travel intent signals, however, it does not capture one hundred per cent of the travel market.

Key market updates

As the Middle East and Africa (MEA) continue to monitor travel as a result of Covid-19, there have been plenty of updates on travel restrictions and border openings over the last few weeks. Passengers arriving in Dubai from Gulf Cooperation Council (GCC) countries no longer require a pre-flight Covid-19 Polymerase Chain Reaction (PCR) test. However, the exemption is not applicable to passengers arriving by road through the Hatta border. With regards to vaccines, Saudi Arabia has approved the registration of the Pfizer Covid-19 vaccine and has reopened its borders to international travellers. Oman and Kuwait took similar precautions by closing their borders in December, but have since begun welcoming international visitors again. To limit the spread of the virus, strict health and safety guidelines remain in place. In addition to this, in a bid to boost tourism recovery, Oman has granted visa-free entry to 103 countries for stays of up to 10 days.

The actions detailed above will almost certainly have a positive impact on tourism recovery across the region, and travel intent and confidence will likely grow over the coming weeks and months as a result. However, the region is still being suitably cautious as cases have risen over the past few weeks across the UAE. As such, the UAE has now been removed from the UK’s travel corridor list, meaning that people arriving in the UK will need to self-isolate.

Airspaces reopen as ties are restored with Qatar

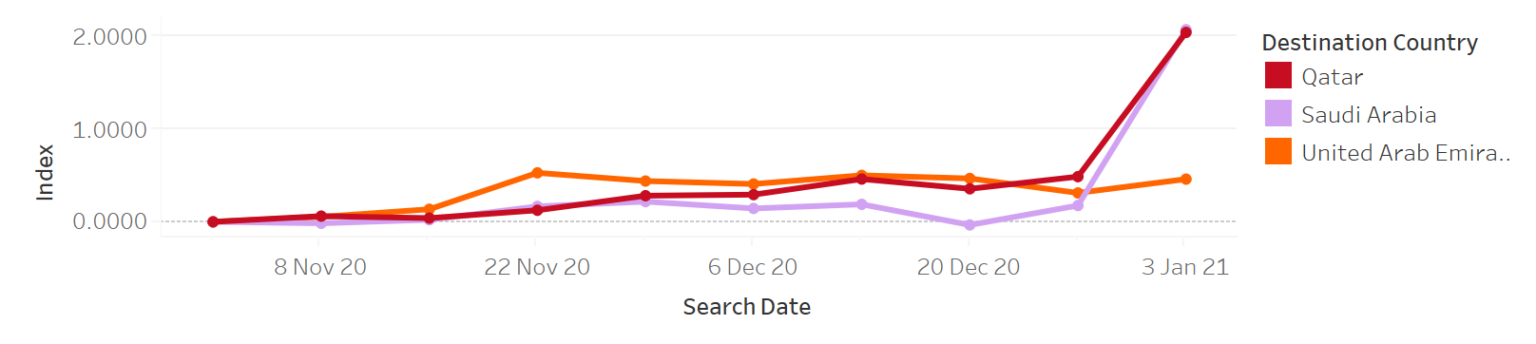

The last couple of weeks have brought with them announcements relating to the reopening of borders across the GCC. The most welcomed news was the reopening of the airspace between Saudi Arabia, the UAE, and Qatar, as a result of full diplomatic relations being restored. Along with this news, and other restrictions being lifted across the region, we are seeing positive international travel intent to the three GCC countries. When looking at global flight searches to these three destinations the last few weeks have shown a steep incline in search volumes inbound to Qatar, whereas intent to travel to the UAE has plateaued. This in part could be due to the rising number of cases which has led to the reimplementation of self-isolation periods when travelling internationally to particular destinations. We would expect over the coming weeks that regional travel intent and confidence will continue to grow.

Global flight searches to Saudi, Qatar, and the UAE – indexed to w/c 1st November

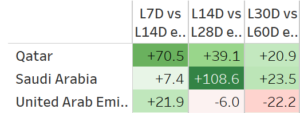

When comparing intra-regional travel intent from the last 14 days with searches that have been made over the last week, out of the three GCC countries discussed Qatar has experienced the most dramatic change with an increase of 70.5 per cent. Although this cannot be linked directly to the news mentioned above, it is clear that intent to travel within the region is growing. This potentially highlights interest in the new opportunities to travel across the borders presented by relations being restored.

Last 7 days vs. last 14 days of regional travel flight searches

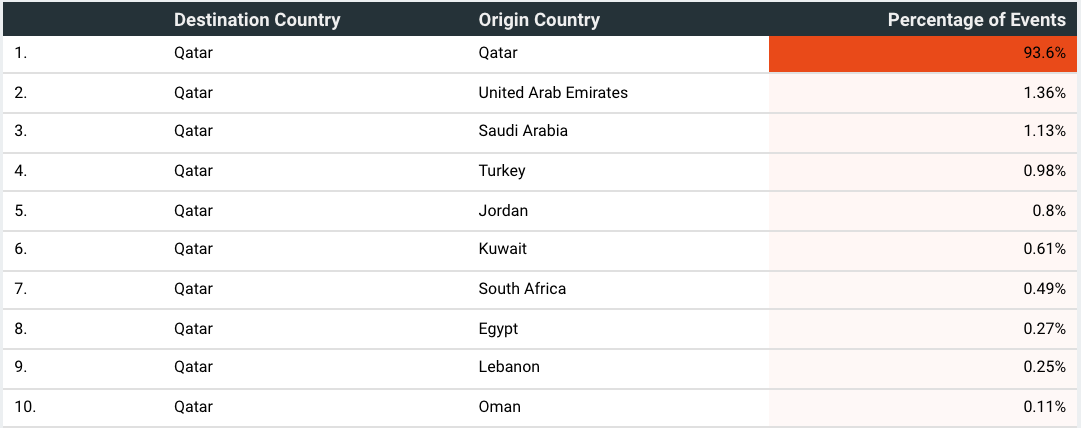

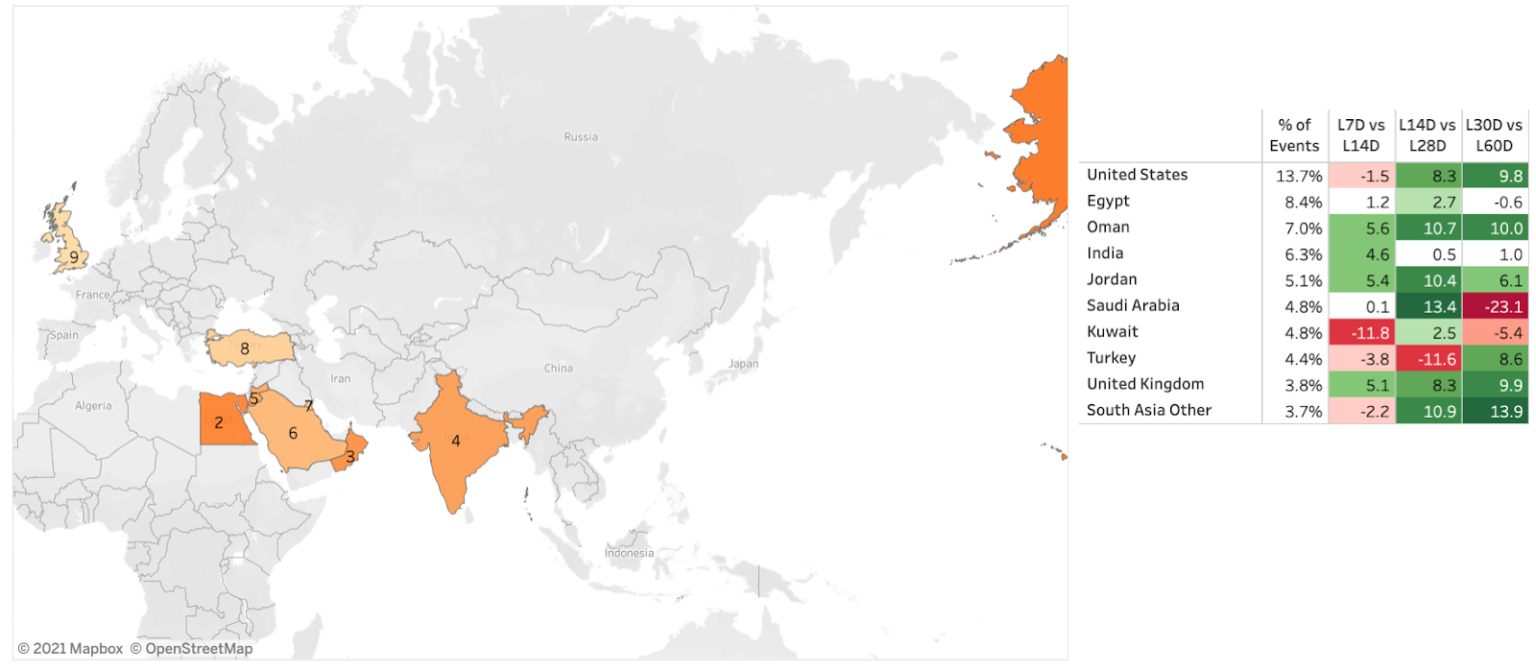

The UAE and Saudi Arabia among top origins for Qatar

Although domestic travel is leading the way for Qatar, regional hotel searches show that the next two top MEA countries for looking to book a stay in Qatar are the UAE and Saudi Arabia. However, of those planning to fly to Qatar, the United States accounts for 14 per cent of inbound searches over the last 60 days. Currently, Saudi Arabia accounts for almost 5 per cent of flight searches over the last couple of months, surrounded mainly by other MEA origins highlighting high levels of regional travel intent. A positive increase in search volume to Qatar in the last 14 days from Saudi Arabia can be observed as compared to the searches in the last 28 days.

Top MEA origins to Qatar – hotel search volumes in the last 60 days

Top global origins to Qatar – flight search volumes in the last 60 days

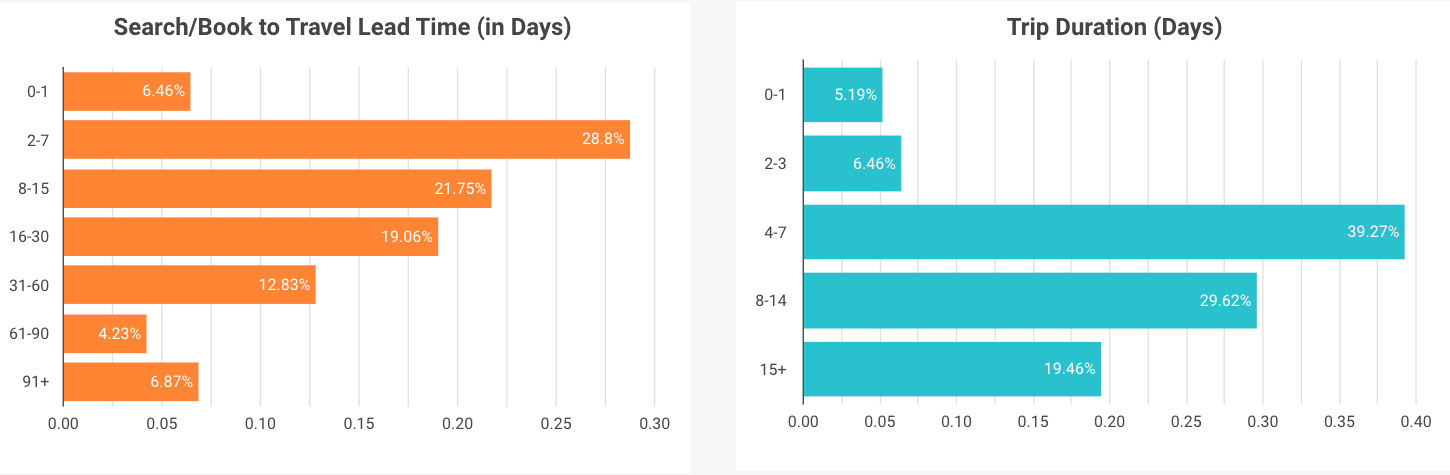

Travellers are looking for longer trips to the UAE

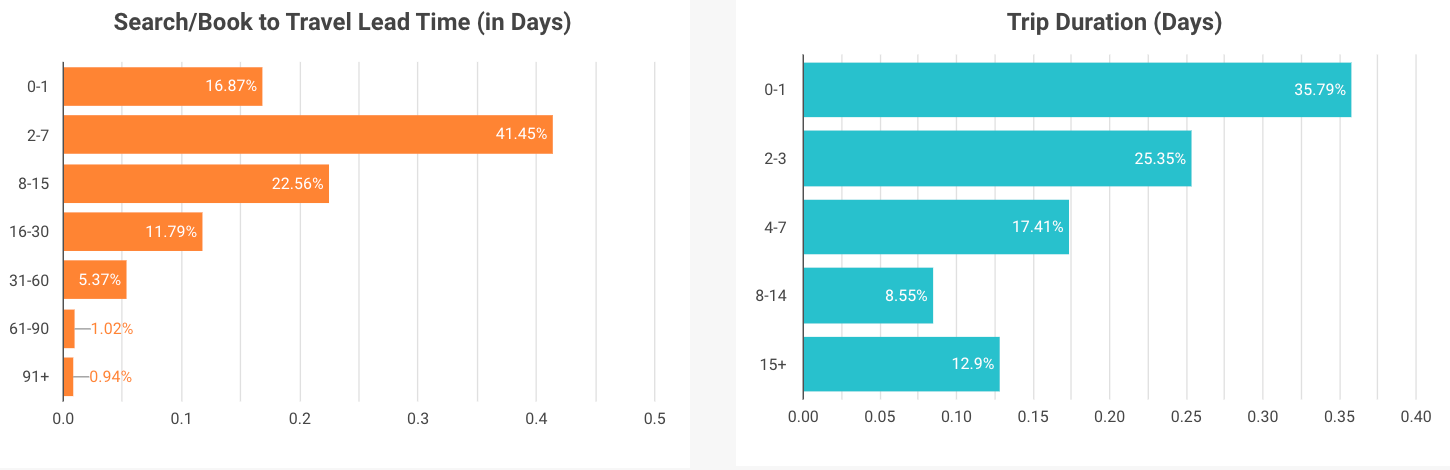

With domestic and regional travel still showing faster signs of recovery than international travel, it is no surprise that booking windows remain short as travellers keep an eye on travel restrictions. This is the picture across Saudi Arabia, Qatar, and the UAE, as the large majority of searches and bookings are being made two to seven days in advance of the trip. Although the booking windows are short for those looking to travel to the UAE, roughly 60 per cent of trips being planned and booked are for a period of eight days or more. Given the strong lead from domestic travel across the region, especially in Saudi Arabia and Qatar, the short booking windows, as well as preference for shorter trip durations, are understandable.

Lead Time and Duration for Key MEA Markets

UAE

Saudi Arabia

Saudi Arabia

Qatar

2021 has brought with it the opening of borders, updated travel corridors, and developments in the vaccine, which has each undoubtedly had an impact on travel. The newly restored diplomatic relations between Saudia Arabia, the UAE, and Qatar appear to have shone a positive light on travel intent, and intra-regional travel shows very early signs of picking up. We will continue to share more insights as we monitor the situation. Booking windows remain short, and travel remains mostly domestic and regional, but there are positive signs of international travellers growing more confident in booking trips to the region. These forward-looking insights will hopefully help travel marketers across the region shape their strategies as the industry recovers.