TailWind brings you Covid-19 insights from GlobalWebIndex a leading market research company operating in 45 markets inclusive of MENA. Tailwind, a TDG Company, is the exclusive partner for GlobalWebIndex in the region, bringing local businesses powerful consumer insights.

Tourism was the industry that was hit hardest by the effects of the pandemic. Major companies in the sector, like AirBnB, Marriot, or TripAdvisor announced millions of lost revenues, widespread layoffs and furloughs in early 2020, leading up to stark predictions of up to 50% of shrinking of the sector (source). The size of the pandemic’s impact in tourism is also reflected in our latest research.

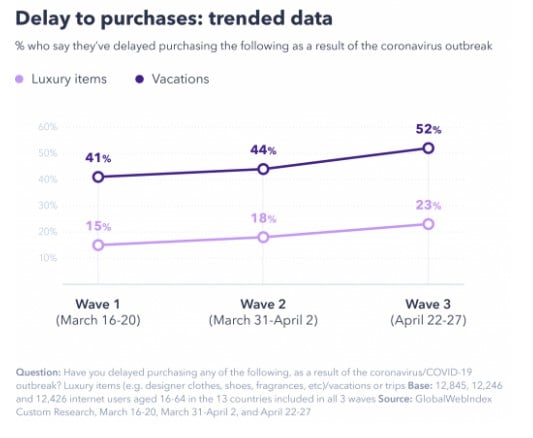

Our data shows that globally, it’s now more than 1 in 2 consumers who say they have delayed booking a vacation; Indeed, across the 3 waves of research, we’ve seen consistent increases in delayed vacation purchasing in every market. For example, it’s grown from 28% in France in mid-March to 48% in mid-April; and in the U.S. the numbers have risen from 30% to 49% over the same period. The figure peaks at close to 60% in China and 46% in UK, two of the key markets for incoming tourists in UAE, Dubai, one of the most popular tourism destinations in the world (source )

Next Destination: Vacation

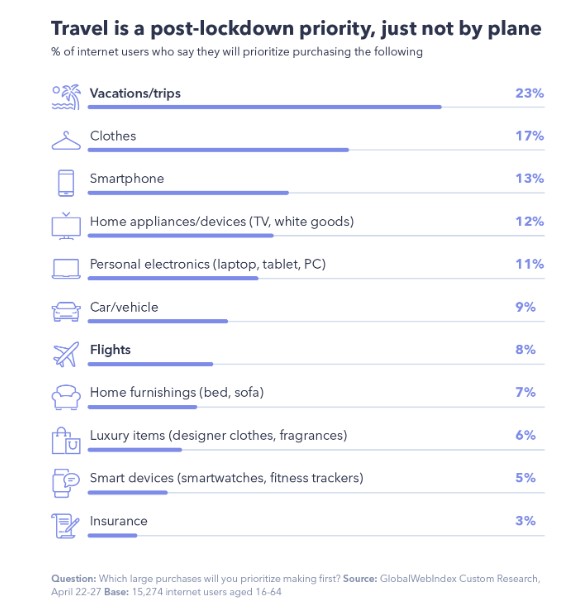

Vacations emerge as the top priority on post-outbreak purchases. Almost a quarter say this will be their first purchase, rising to almost a third among the most affluent group. There’s an age-pattern at work too; the older the consumer, the more likely they are to prioritize booking a vacation (with boomers scoring 29%, vs. 18% for Gen Z – the latter being most focused on clothing at 25% and smartphones at 20%).

Although vacation is a priority after the lockdown, the big question remains: When are people planning to travel? Our previous research findings suggest that over 50% of the respondents are planning to resume their vacation planning when the outbreak begins to decrease or finished in their country. Consistent with the guides of several EU countries and UAE where they plan to welcome tourists back in July, there is a long way before tourism comes back to (the new) normal (source ).

Travel Advisory: How to rescue the tourism industry

So, will tourism be able to recover from this challenging moment? Our insights say yes, as long as industries adapt to the new reality and make the most of it. Here are some of the main themes that occurred from the data along with some practical advices on how to overcome the challenge:

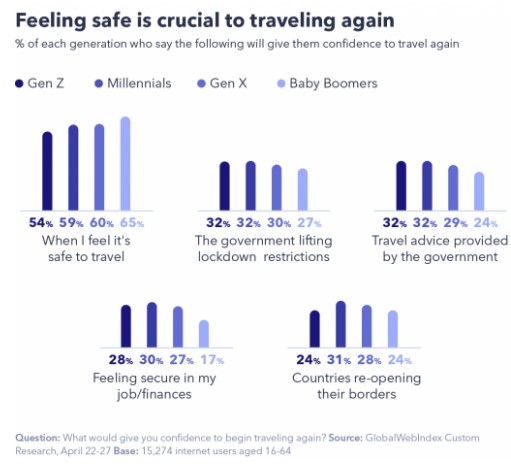

- The safety factor: when asked what would give them confidence to travel again, a personal feeling of safety is by far the top option among respondents – scoring 58% globally. Safety is also paramount for boomers, where 65% select it. The new normal requires every company in the tourist sector will need to keep the highest hygiene and sanitation standards. The ones that adhere to these standards before it becomes a governmental regulation will be the ones that will stay ahead of the curve.

- The staycation factor: Only around 20% say they don’t plan to make any changes to their vacation behaviors. The most popular option at the moment is to have more staycations / trips in the local area, followed closely by taking more domestic vacations. This reflects a combination of two factors: the feeling that one’s own country is outperforming the global average, together with the importance of safety vacations. The opportunity here for tourist sector is obvious: focus on the local vacationer. Although it might be hard as certain companies have set up their whole business model around foreign tourism, the new paradigm dictates that it might be unnecessary risk to travel by plane just to entertain oneself. So, re-think your business model to find the right balance and shift the focus on locals.

- The communication factor: When respondents were asked if brands on the tourism sector should carry on advertising as normal, opinions varied. Over a third agreed, just over a quarter disagreed and just over a third declaring that they aren’t sure. However, the majority of the respondents approved of brands that run Covid-19 related advertising. The lesson here is that the tourism sector should approach vacationers with empathy, acknowledging that today we are living in a brand new world which is different for all us and to adjust their message accordingly.

It is undeniable that no industry was affected worse than the tourism one. Due to the extended lockdown people are delaying the purchasing of vacation for indefinite amount of time. Even more, it seems that even when they will decide to go back on vacation, the way that they will do it will be wildly different. It is critical for the industry to adapt quickly to the new reality and create an opportunity out of this tragedy. Using data that one can rely on to create strategies, will give the sector a chance to survive.

Tailwind and GlobalWebIndex are strongly committed to keeping Covid-19 insights free to all during this challenging time. For more insights and upcoming research, you can find all of GWI’s Covid-19 related free resources here