Between 2020 and 2021, social media users in Saudi Arabia surged from 25 million to 27.8 million; an 8 per cent year-on-year growth equating to 80 per cent of the country now using social networks and messenger services. We’ve deep-dived into KSA Digital 2021, published in partnership between We Are Social and Hootsuite, to understand the unique data patterns and behaviours in the kingdom – highlighting four key trends for 2021 and beyond.

Between 2020 and 2021, social media users in Saudi Arabia surged from 25 million to 27.8 million; an 8 per cent year-on-year growth equating to 80 per cent of the country now using social networks and messenger services. We’ve deep-dived into KSA Digital 2021, published in partnership between We Are Social and Hootsuite, to understand the unique data patterns and behaviours in the kingdom – highlighting four key trends for 2021 and beyond.

1) Human connection drives hyperconnection

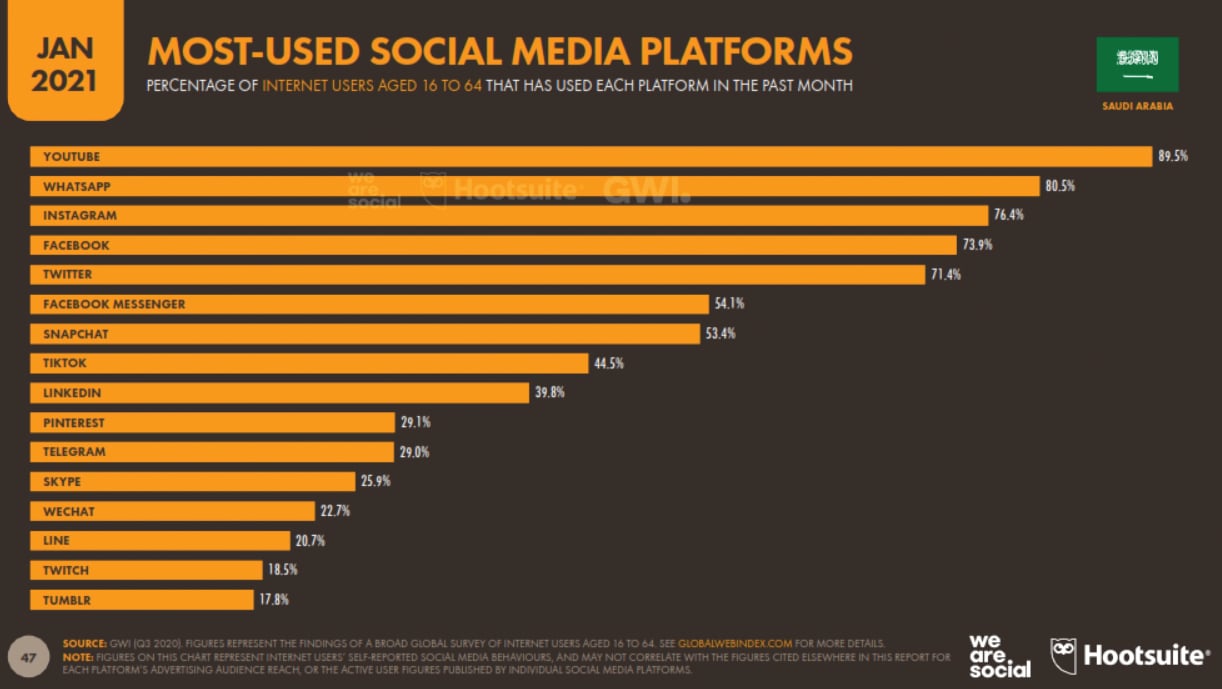

A year of intermittent lockdowns has seen social media channel penetration for almost all platforms rise ahead of global trends, with the biggest increases seen on YouTube (+14.5 per cent), Twitter (+13 per cent) and TikTok (+12.8 per cent) when comparing the KSA Digital 2020 and 2021 reports.

So why are Saudi consumers such fans of Snapchat and Twitter? Why are they commonly described as ‘hyperconnected’, ‘socially savvy’ and‘ digital natives’ in the first place? Because – data.

We know they spend, on average, 3 hours and 6 minutes on social a day – ahead of the global average of 2 hours, 25 minutes. They also have on average almost 10.4 social accounts per head, two more than the global average. When combining these stats, with Saudi’s young average consumer age of 32 and their high uptake of smartphone usage (98.7 per cent of 16- to 64-year-olds) it isn’t so surprising. Then add in the high percentage of expats (roughly 30 per cent), as well as geographical barriers and cultural benefits of private platforms like Snapchat; we see that to KSA consumers social is culture. Hyperconnectivity equals human connection.

Brand Takeaway: Rather than getting distracted by the (big) numbers, try asking first and foremost: Why do we want to engage with them in the first place? Then: Are they using social in a particular way that will help unlock a two-way communication? Which platforms would be most relevant to their motivations? Finally: How can I use channels to achieve desired outcomes? And remember, you don’t need to use them all. Our audience is truly platform-fluid.

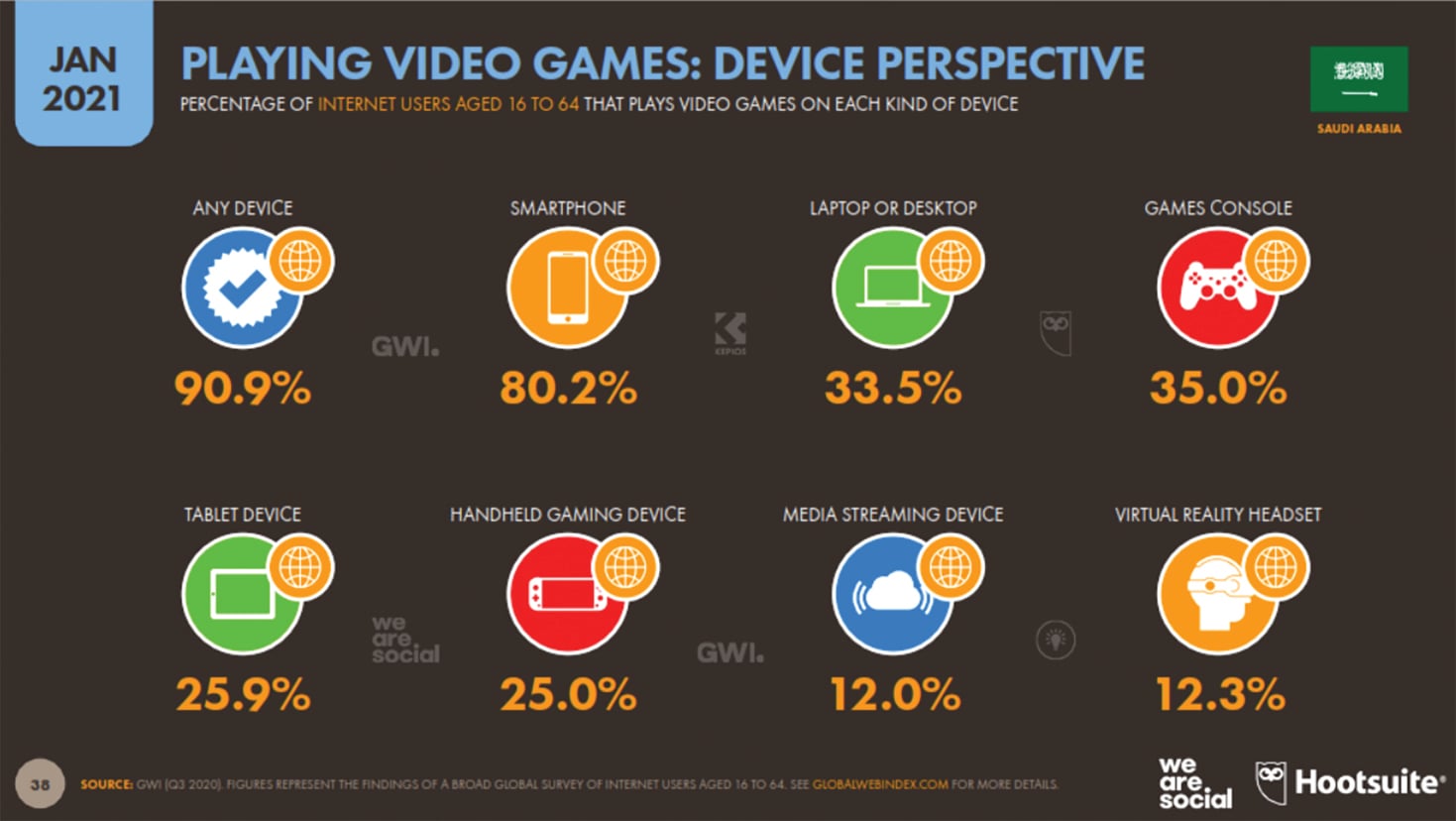

2) Gaming becomes social media

As Peter Mazloumian, Head of SLZ Gamez, puts it, “For starters, Covid-19 made a gamer out of most of us. With a new-found abundance of time at our disposal, we started seeking new ways to keep ourselves entertained.” This rings true when looking at KSA, where gaming has become a growing area of interest, with a huge 91 per cent of internet users aged 16-64 reporting they play games on any device. Console play, in particular, has grown, from 19 per cent to 35 per cent, for an extra 25 minutes per day, when comparing our Digital 2020 and Digital 2021 reports.

Brand Takeaway: Our three ‘rules of play’ are:

Read the room: When playing on new turf we need to respect existing online cultures; offer more than self-serving product placements, and instead use time to create a positive impact in the communities.

Not just any ad: Creative has to be crafted with the spirit of gaming at its core, born from truths that gamers can connect with and executed bespoke to platforms and communities.

Play like a streamer: Take Twitch, for example. Whether bringing gaming characters to life or ‘raiding’ streams of smaller channels for a good cause, remember the platform’s purpose, and let brands enter the lives of gamers by simply playing alongside them.

3) The switch from search to social search:

Between 2020 and 2021, we’ve finally seen the scales tip. In KSA, the preferred primary way to conduct brand research among internet users aged 16-64 is to refer to social media, with 60 per cent using this channel, ahead of 58 per cent who use search engines. No other channel is close in terms of use – in third place comes consumer reviews, which 38 per cent of this group use to do brand research.

This could be a direct result of a distinct lack of Arabic-first search approaches from brands, favoured instead by Arabic-first social approaches, which result in richer Arabic social content, and search strategies primarily in English.

Brand Takeaway: When we say ‘social search’, it’s important to remember consumers don’t just actively visit brands’ social pages. Search is conducted in numerous ways via hashtags, explore tabs, shopper tabs, Instagram Reels, vloggers and influencers, and ads served. Brands must adopt a multi-faceted approach, so they’re visible and available in the right spaces for your consumer. This also allows for organic frequency – the more they see you across different channels in different forms, the stronger your brand recall will be.

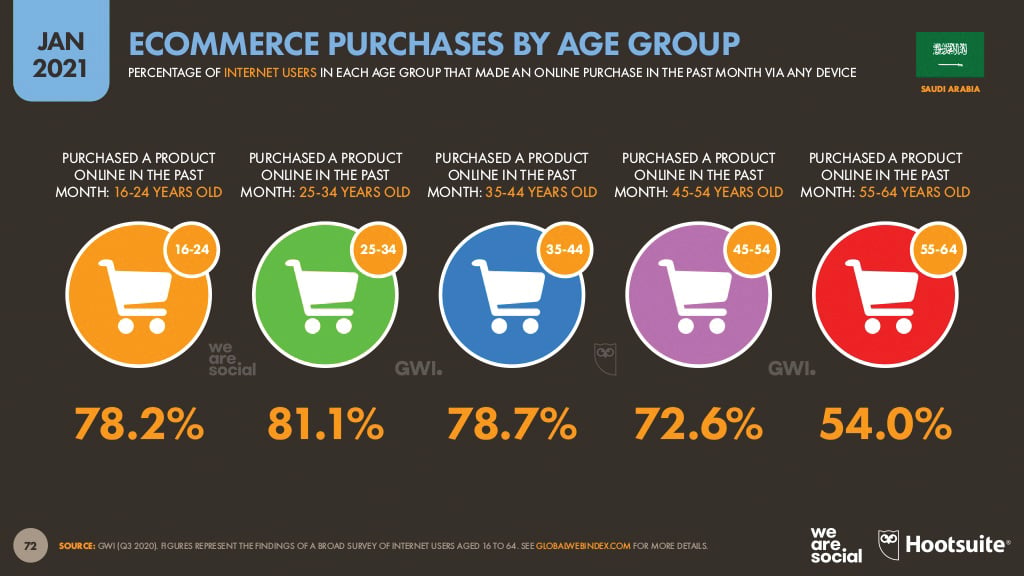

4) Age-agnostic e-commerce growth

The growth of e-commerce in KSA has been accelerated by Covid-19, with consumers forced to shop from their homes – and the extended length of the pandemic forming long-lasting habits. With this, we’ve seen the use of shopping apps increase from 55 per cent to 68 per cent year-on-year in KSA, and an annual growth of 38 per cent in the consumer products e-commerce market.

The surprising takeaway from the data is that internet users in Gen Z (age 16-24) are no more likely to use e-commerce than millennials (25-34) or even young Gen X. In fact, each age range from 16-54 has similar e-commerce adoption, and we only really see a drop off with consumers aged 55+.

Brand Takeaway: All consumers shop online. Brands need to be where the consumer is (which is everywhere) with a focus on ‘aggressive’ acquisition of new customers and first-party data. Measurement is key to understanding how to strategically, and often very quickly, pivot an approach, as well as keeping up to date with the rapidly changing ecosystems and inventory available to continually optimise the ever-fluid consumer journey.