2020 challenged our lives in ways we never imagined, from figuring out how to have anything and everything delivered to our doors to annual leaves spent in our living rooms, to family gatherings conducted over video conferencing software. The same is true for brands and the way they operate, communicate and sell to consumers.

2020 challenged our lives in ways we never imagined, from figuring out how to have anything and everything delivered to our doors to annual leaves spent in our living rooms, to family gatherings conducted over video conferencing software. The same is true for brands and the way they operate, communicate and sell to consumers.

The global pandemic led many brands to re-evaluate their operating models as well as current and future advertising and marketing strategies. Worldwide, brands felt the pinch in the form of shrinking budgets and uncertain financial prospects.

Research(1) has shown that brands that continue to advertise and communicate in times of recession not only fare better during the recession but benefit after it as well. They are often competing against less ‘noise’ as others choose to go ‘dark’.

In an attempt to increase brand salience amidst the pandemic, many brands are focussing on customer retention in their advertising and promotional efforts with the aim of convincing existing customers it’s safe to come back and interact with the brands they already love.

Whilst this is a prudent strategy, focusing on attracting new customers with a favourable brand view may prove a more fruitful approach in 2021 and brands can do so by understanding this audience.

Utilising the newly launched audience segmentation and profiling tool – YouGov Profiles, brands and agencies can look to understand where the best opportunities lie moving forward and also how best to activate against those audiences.

To demonstrate this, YouGov has examined data on the fast-food sector in the UAE to better understand the fast-food customer audience and identify where these brands should focus their communication efforts in 2021.

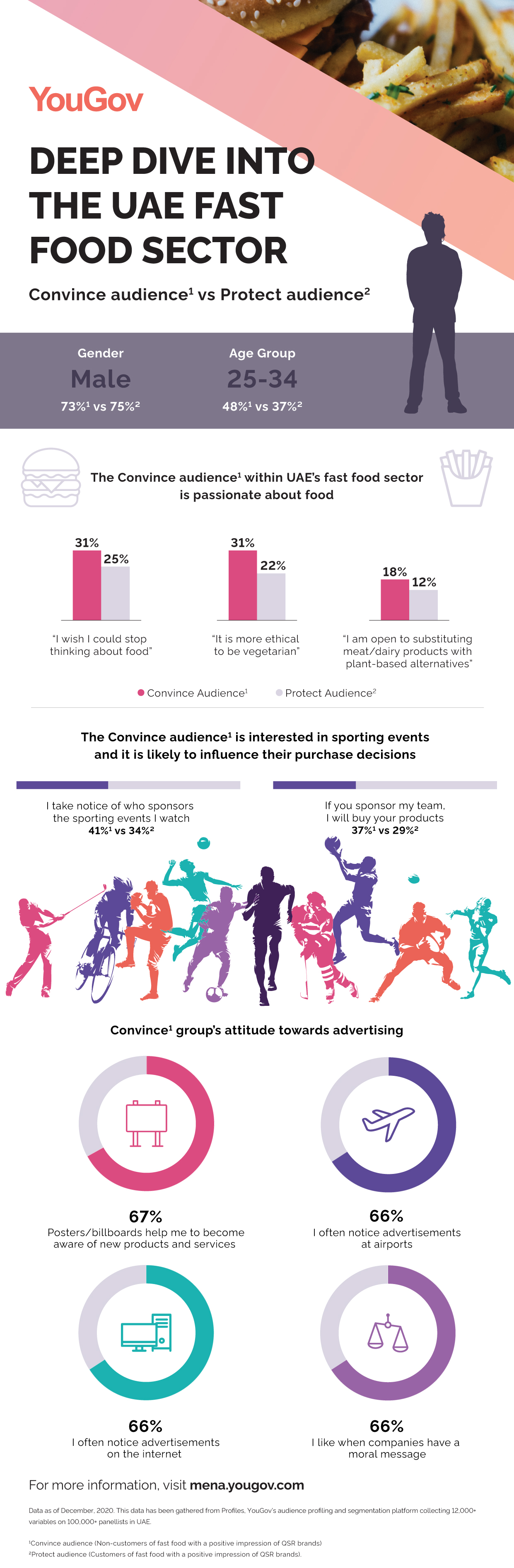

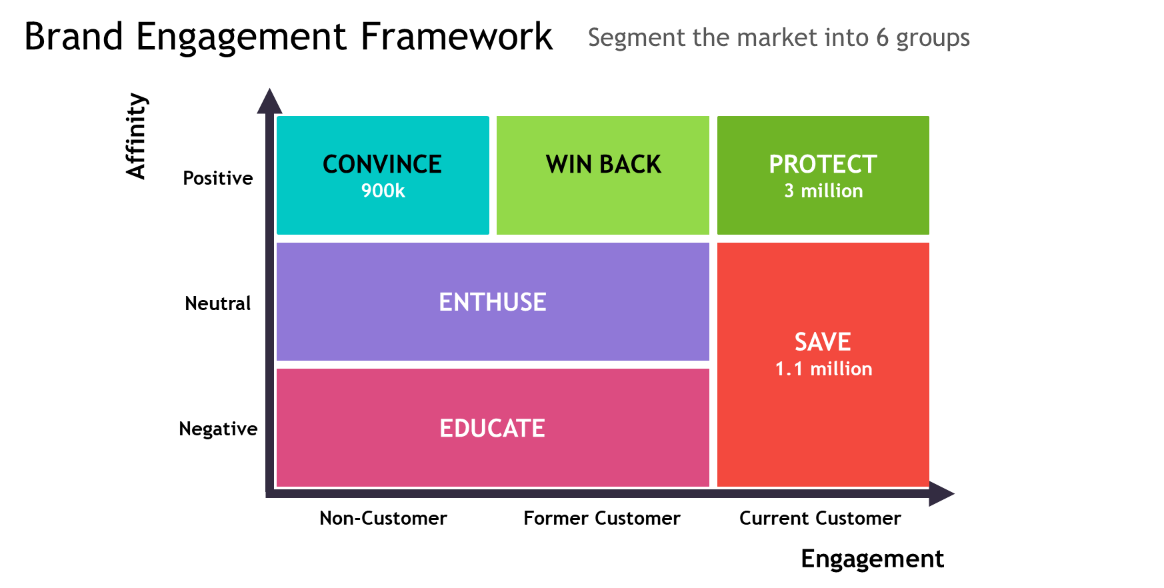

To begin with, YouGov’s Brand Engagement Framework looks at affinity towards the brand and segments the audience by customer status vs this affinity. This analysis identifies six audience groups for a brand or set of brands, namely- Convince, Win Back, Protect, Enthuse, Educate and Save audience.

Logically, retention is primarily focused on the Protect and Save audiences with the Save audience being the audience most at risk. Based on this framework as applied to fast food brands, however, the ‘Convince’ group presents another substantial audience that is already positive towards the brand, but does not or has not used it. Providing we understand who these folks are and how they like to be communicated with, we can focus our efforts on winning these new customers instead of only saving or protecting our existing customer base.

Who are these people?

YouGov Profiles allows one to Identify, define and target this audience like never before. Using the 12,000 variables currently tracked within Profiles for the UAE, we have taken a closer look at this ‘Convince’ audience to better understand what makes them tick.

This audience is young, with a large proportion (48 per cent) falling within the age group of 25 to 34 years.

Compared to those who are already customers of fast-food brands with a positive impression (protect group), the convince audience group is more likely to say their eating behaviour has changed due to the pandemic. One in ten of them (11 per cent) claim to be dining out ‘more often’ in the past two weeks as a direct result of Covid-19, as opposed to 4 per cent of protected group respondents. This suggests now may be the right time to reach consumers in this target.

The Convince audience appears to be passionate about food and show an inclination towards vegetarianism or veganism. Messaging around food quality including options such as beyond meat and impossible burgers seems to be appropriate to attract this group.

Their enthusiasm for live sports and the likely influence of sports on their purchase decision serves as an opportunity for brands to catch their attention and engage them.

When it comes to their attitudes towards advertising, they are more likely than the protect audience to engage with advertisements tailored to them (17per cent vs 11per cent). Advertising for this group needs to be more focused around their likes and dislikes and their beliefs, as this will resonate more with them.

Using these amongst many more granular insights about audiences through YouGov Profiles, a brand can understand its target audience better in order to develop a strategic plan to increase relevance to consumers outside its current customer base.

In general, a data-backed approach helps brands tailor messages and relay them at the right time to build relationships with each individual target audience: win new customers, re-engage former ones and remain relevant to current buyers.

Powered by the world’s largest connected dataset, YouGov Profiles gives marketers a richer, more detailed portrait of their customers’ entire lives, allowing businesses to understand the profile of their target audience across multi-channel data sets with greater granularity and accuracy than ever before.

Learn more about YouGov Profiles here.

References:

(1) Tellis, Gerard & Tellis, Kethan. (2009). A Critical Review and Synthesis of Research on Advertising in a Recession. Journal of Advertising Research. 49. 10.2501/S0021849909090400.

https://www.researchgate.net/publication/228272297