By Rob Clapp

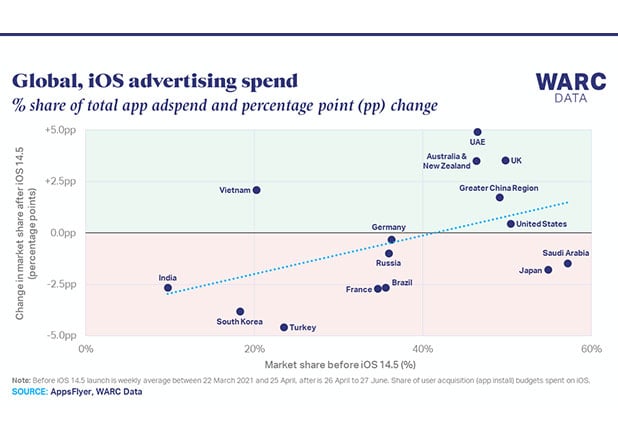

Apple devices are capturing a larger share of advertising spend following the release of iOS 14.5, but only in markets where iOS has historically been an important player, according to a WARC Data analysis of AppsFlyer data.

Among the seven markets where Apple took at least a 40 per cent share of advertising spend before iOS 14.5, five of them (71 per cent) have seen Apple grow its share since launch.

For example, iOS devices took a 49.8 per cent share of app advertising spend in the UK before the launch of iOS 14.5. Following the update, this has risen 3.5 percentage points (pp) to more than half (53.3 per cent) of advertising investment.

On the other hand, in the eight markets where Apple has historically taken a less than 40 per cent share of advertising spend, seven of them (88 per cent) have seen Apple’s share declined since launch.

For example, just 9.7 per cent of Indian app advertising spend was for Apple devices before the iOS 14.5 update and this has now fallen by almost three percentage points to 7.1 per cent.

This suggests that in markets where Apple is less relevant, advertisers have been willing to shift budgets to target more data-rich Android devices. However, in markets where Apple plays a more important role, advertisers have been reluctant to move their investment. This could ultimately help Apple in its quest to establish an ad business in major advertising markets like China, the UK and the United States.

On a global basis, however, Apple’s market share has dipped following iOS 14.5 – it averaged 42.7 per cent of global app advertising spend before and this has since fallen to 41.8 per cent. Android investment has accelerated over this same period.

Additional data show that just a quarter of Apple users have allowed app tracking, posing a fundamental challenge to the more than $200bn spent on mobile advertising which relies on personal data. WARC’s latest research finds that 62 per cent of marketers believe the ‘death of the cookie’ will significantly impact their mobile marketing strategy.

Both advertisers and publishers are now focusing on new solutions to bridge the identity gap across digital channels, with first-party data becoming more prominent. Brands can also try using this new approach to innovate on the creative front, particularly as data-rich audiences are those most turned off by excessive targeting.