UAE and KSA are the fastest-growing markets in EMEA, IAB MENA reveals in its latest study.

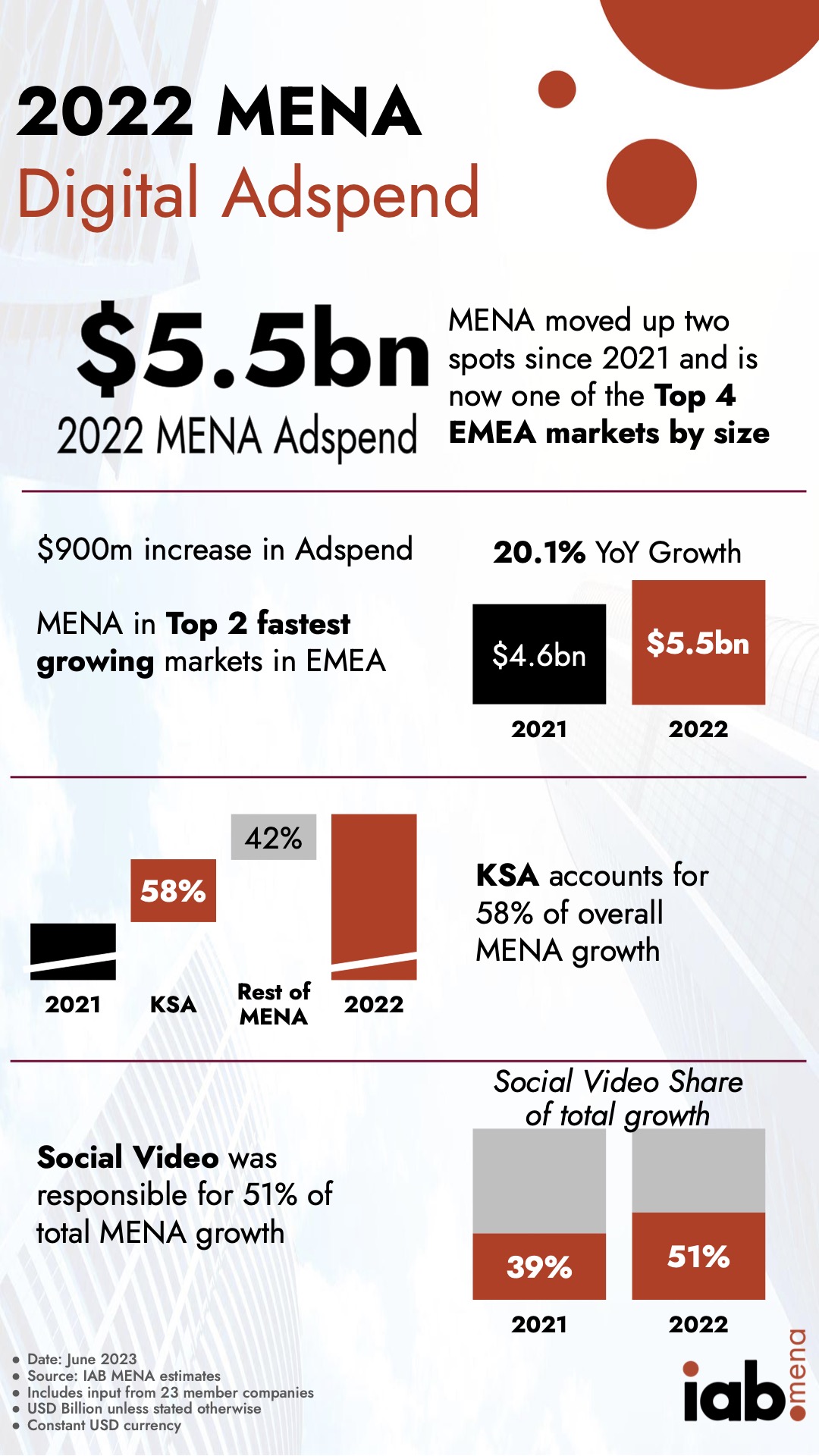

The study revealed that MENA’s digital advertising spend reached $5.5bn in 2022, showcasing a growth of 20.1 per cent increase from the previous year.

With KSA alone accounting for 58 per cent of total MENA growth, the country joins the top 10 EMEA markets by size for the first time. Individually, UAE and KSA are in the top three fastest-growing markets in EMEA.

The growth also places the MENA region among the fastest-growing regions in EMEA.

“The fact that MENA growth continues to outpace the rest of EMEA, despite its significant size, is real evidence of the region’s vibrancy,” says Ian Manning, IAB MENA Executive Director.

The spend has added more than $900m to the market, ranking the market in the top four EMEA markets by size.

Michel Malkoun, Chair of the IAB MENA Board adds, “The growth is not only driven by cyclical or short term factors, but also by some structural market conditions and thus we believe we will see the strong growth trend continue.”

Social video at the top

The report also looks at advertising spend by media in the market with social video accounting for 51 per cent of the total growth.

Vice-Chair of the IAB MENA Board, Mohamad Itani said that the market is still a video-first market and social still takes the “largest share of the pie”.

However, he also mentions the “growth potential” for the CTV, DOOH and Retail Media and how they will be a “pivotal part” of the market’s future growth.

As in previous years, the methodology of the report includes a mix of the actual advertising spends, team estimates, mathematical modelling and comparative benchmarks to reach agreed figures and growth rates.

“With increased participation we were able to continue to improve the detail in the report and provide a more insightful picture of the market,” Manning adds.

The full report, available only to IAB MENA members, includes detailed breakdowns and regional granularity, and estimates on the size of programmatic buy types and social video.