The unquenchable thirst for convenience is changing the customer behaviour, but Quick commerce has grown beyond that It’s no more a convenience-driven trend – It’s a phenomenon, a catalyst for positive change revolutionising the entire supply chain.

The fast-paced Q-com landscape is expanding far and beyond major hotspots in UAE online marketplaces with the big players entering space and battling the local giants. The flourishing quick commerce landscape in a diverse ecosystem has been battling it set of challenges like optimising product performance across platforms.

UAE is witnessing an astronomical rise in the Q-com ecosystem projecting annual growth rate of approximately 8.02 per cent CAGR and projected market volume to sore beyond $219.90 million by 2028 from projected $161.50 million in 2024 (Source: Statista)

So, what does it take to stay ahead in wooing the shoppers? Understanding the heart of Q-commerce the insights on being available at the right spot and reaching out to the consumers that crave more than just products – cater to their demand for an experience that is fast, reliable, and convenient building brand trust and loyalty.

RoadMap to Optimise Q-commerce Customer Journey

The competitive landscape means brands need to be on their toes in terms of what’s happening on various platforms and at a hyper-local level across geographies. The monitoring must go deep down on multiple KPIs.

A customisable solution with the capability to scan platforms multiple times during the day during the sale season, provides competitive analysis based on the need of the e-commerce business venturing on quick commerce platforms is the need of the hour.

Every touch point on the customer journey – from generating interest and awareness, consideration and evaluation and purchase and post purchase phase must be optimised. This must cover brand, sub-brand, categories, sub-categories, and product variants.

On Q-com platforms – one of the major challenges for brands looking to optimise the customer journey is monitoring and enhancing availability on the dark stores in the regions. To stay ahead in the quick commerce race, your products need to be on the shelf, competing not going out-of-stock.

Preventing stock-outs keeps the products in the race to woo the shoppers and also preserves trust along with enhancing credibility among shoppers.

Why do brands need to track availability on Lat-long analysis rather than at postal code or zip-codes?

Brands need the capability to track availability to monitor the exact location of the dark store with digital commerce intelligence solution to identify what is pulling down the availability of the products.

Let’s consider a scenario where your product is under says a biscuit category, or more specific chocolate cream biscuit product variant Showing 60 per cent availability on a postal code – 25314.

Is that information enough? What if among 3 dark stores under the postal code it’s available on 2 say 100 per cent but out of stock on the other?

To prevent such a situation brands, need real time monitoring with OOS alerts and tracking the depletion of stocks and insights versus competition availability.

Get Battle ready on product availability vs competition

One of the biggest multinational food, snack, and beverage conglomerates with digital commerce intelligence on e-commerce and quick commerce enhanced it brand presence and availability in the AMESA region.

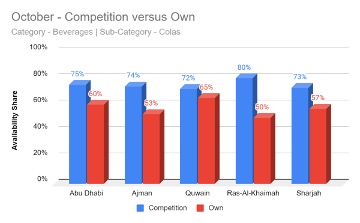

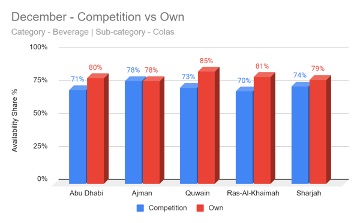

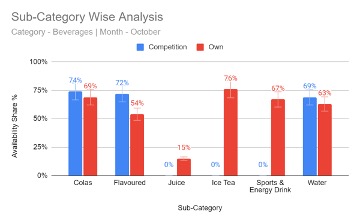

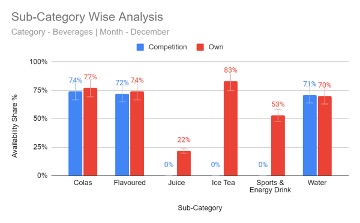

In the UAE they focused on optimizing availability on key platforms Careem, Carrefour, Noon and Talabat for Beverages, Nutritious Food and Snack category.

They identified and acted on performance gaps with global dashboard monitoring availability and other core KPIs. This led them to optimise availability versus competition across platforms and geographies on various categories and sub-categories.

Why do brands need to excel on quick commerce platforms?

The first checkpoint on optimising the customers is staying in the race – prevent stock out. Once you are availability at the dark store make sure the availability doesn’t fall behind the competition.

A momentary lapse in availability can lead to losing a potential customer. Frequent stock-outs also affect brand reputation.

The multinational brand with the global digital shelf tracker brands can optimise the performance of their products across platforms and geographies. They monitored the products across multiple KPIs across the Middle East & North Africa region.

In the UAE region they mainly focused on enhancing its market presence with monitoring availability and optimising share of search.

Monitoring stock availability at the dark stores gives the brand an added edge over the competition across platforms. This intelligence also enables brands to re-stock on time and identify the demand across locations.

The ability to identify and plug the availability gaps helps make data-driven decisions to optimise performance and ensure that their products are consistently accessible to the shoppers.

Brands need deep insights across e-commerce platforms and quick commerce to optimise the customer journey. The competitive insights and intelligence must include:

- Brand Availability Trends

- Availability share versus competition

- City-Wise Availability Trends/Lat-long Analysis

- Platform-wise & geography-wise analysis

- Insights that help identify geography to target

- Out-of-Stock product lists & alerts

The real-time insights enable brands to adapt swiftly to market dynamics and consumer demands.

Furthermore, the focus on optimising product page content and overall product performance on e-commerce and quick commerce platforms enhance customer experience, product discoverability and online presence.

The Final Thought

The digital commerce landscape is expanding in the region and quick commerce is picking up pace. The thirst for convince is driving shoppers towards quick commerce. Brands need to siege the opportunity amidst stiff competition by optimising every touch point on the customer journey.

Match and track every move of the competition across the digital commerce landscape.

-By Amit Relan – CEO and Co-Founder & Dhiraj Gupta – CTO and Co-Founder