"Gen Z, is more interested in shareable moments than static assets; luxury is being redefined as what you feel, not just what you flaunt."

"Gen Z, is more interested in shareable moments than static assets; luxury is being redefined as what you feel, not just what you flaunt."Luxury used to be defined by rarity, craftsmanship and price. However, the story is being rewritten – and Gen Z is now holding the pen. In digitally fluent, high-income markets such as the UAE, this generation isn’t just consuming luxury; they’re reshaping it, pixel by pixel, reel by reel.

Yet in the UAE, the story is more than just small volatility, it’s about a generational pivot. Gen Z – digital natives with TikTok reflexes and climate anxiety in their blood – are not perceiving luxury as their parents knew it, they’re not buying logos; they’re buying meaning. In doing so they are pushing luxury brands to evolve, or face irrelevance.

According to McKinsey, the luxury sector rebounded strongly from 2019 to 2023, powered by ultra-high-net-worth individuals.

However, by 2024, signs of a slowdown emerged: 50 million consumers globally exited the market. Amid this turbulence, one trend stands out – Gen Z now accounts for 20 per cent of luxury consumption, with their influence continuing to increase and define the sector, as highlighted by Bain & Company.

From owning to experiencing: The sensory shift among Gen Z

Traditionally, luxury belonged to the ‘esteem’ level of Maslow’s hierarchy of needs — signalling power, exclusivity and status. Gen Z, is more interested in shareable moments than static assets; luxury is being redefined as what you feel, not just what you flaunt.

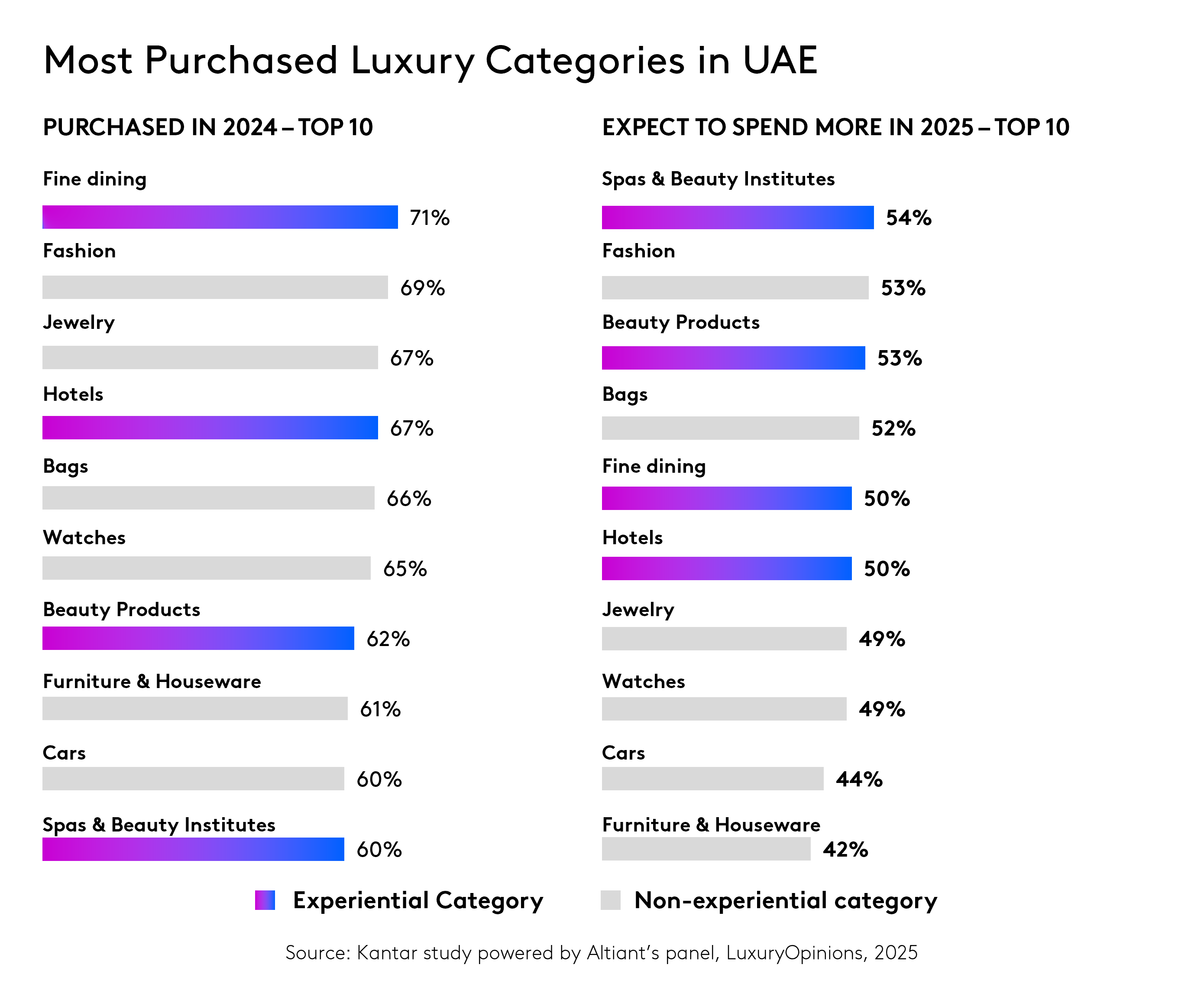

Take the rise of ‘experiential luxury’. In the UAE, luxury isn’t just something you wear – it’s something you feel. Think fine dining, wellness retreats and meticulously curated aesthetic escapes. The experience itself has become the ultimate status symbol and the numbers back this up.

Data from Kantar, in collaboration with Altient, shows that in 2024, 71 per cent of affluent consumers in the UAE indulged in fine dining, while a staggering 67 per cent checked into five or six-star hotels. Here, luxury doesn’t sit behind glass – it’s lived, savoured, and shared. Here’s the kicker, these numbers spike among Gen Z. Looking to 2025, one in two say they plan to spend more on such experiences.

How come? Because experiences can be shared, they can be turned into reels, vlogs, bite-sized dopamine hits. This, too, is luxury; the ability to live a life that’s aesthetically enviable and emotionally rich.

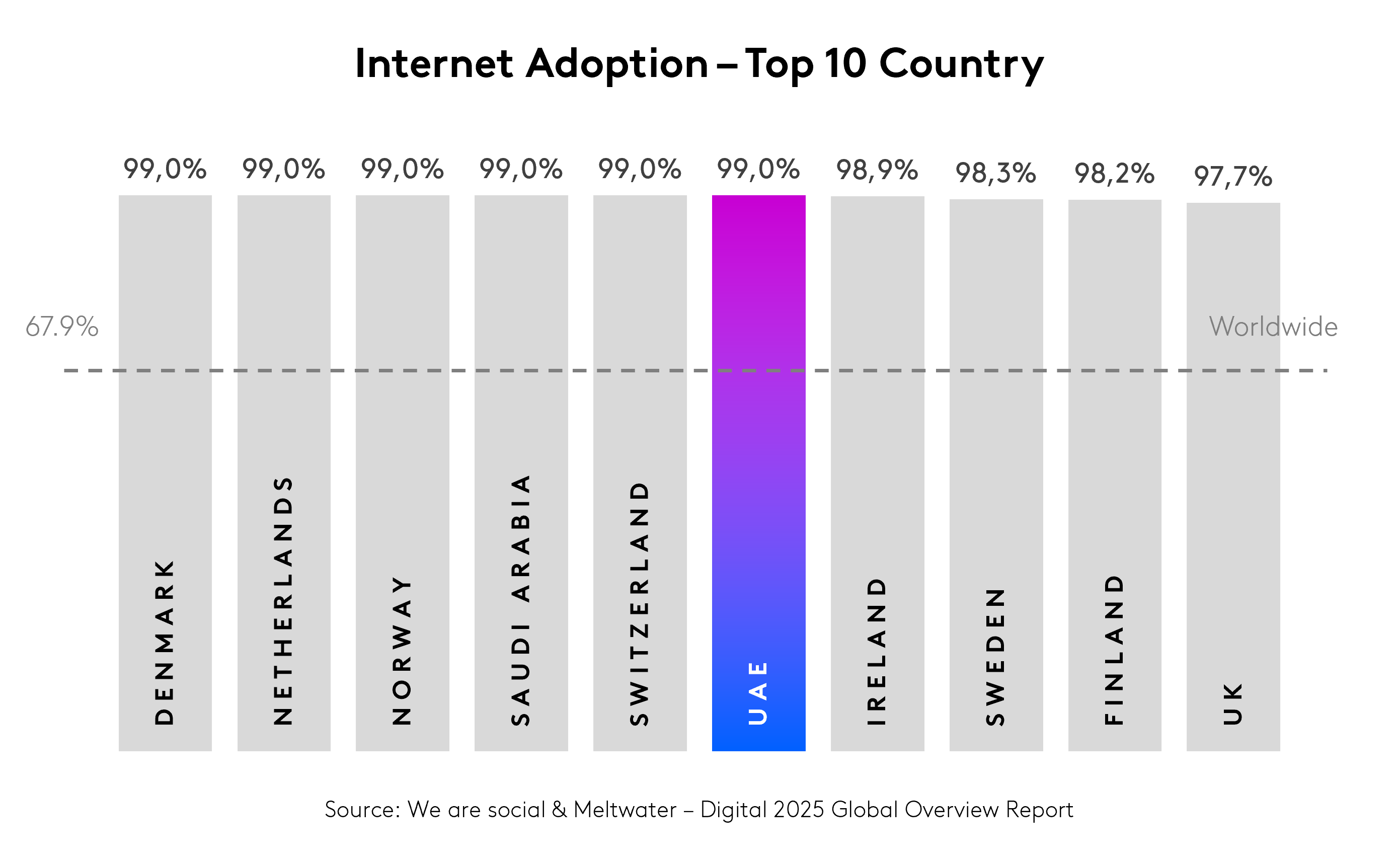

Gen Z aren’t just online, they are online. Born into the scroll, raised on stories and fluent in every platform from TikTok to whatever’s trending, they bring a whole new set of expectations to the table and from brands they want real talk, real people and zero filters.

And nowhere is this digital fluency more intense than in the UAE. With some of the highest social media engagement rates in the world, young consumers here aren’t just following trends — they’re setting them, shaping brand narratives with every like, comment, and share.

Rise of the Instagrammable experience economy

In the UAE, social media isn’t just where trends happen, it’s where luxury lives. For Gen Z, picking a venue often comes down to question, will it look good on my feed?

That’s why places like Atlantis, The Palm and Nusr-Et (aka SaltBae) aren’t just destinations – they’re content factories.

Atlantis is the most ‘Instagrammable’ hotel in the Middle East, racking up more than 670,000 posts under #AtlantisThePalm. From its underwater suites to its jaw-dropping aquariums, every corner is engineered for envy.

Demand for hyper-personalised content

But it’s not just about aesthetics, it’s also about alignment. Gen Z in the UAE is leaning hard into content that feels tailor-made, culturally relevant and organic.

That’s where Huda Beauty comes in. Built by Dubai-based influencer Huda Kattan, the brand doesn’t just sell products, it tells stories Gen Z relate to.

From unfiltered tutorials to brutally honest reviews, Huda’s content strips away the gloss without losing the glam. It works, Huda Beauty saw a 264 per cent jump in TikTok EMV, showing how personalised and value-driven content can drive real engagement.

@therjacobs The secret is OUT. Introducing @Huda Beauty @Huda Easy Bake Setting Spray 🖤 #easybake #easybakesettingspray #hudabeauty #fyp #viral ♬ original sound – Rhea Jacobs

French label Jacquemus is hitting that note. The brand’s collaborations with regional influencers such as @karenwazen make its pieces, bags, accessories and more – feel less like high fashion and more like personal expression.

It’s a strategy that clearly hits home. Jacquemus grew its sales from €200 million to €280 million in 2023, powered by minimalist yet magnetic content that now pulls in over 5 million Instagram followers.

View this post on Instagram

While the brand’s global footprint is impressive, the UAE plays no small part in that momentum, with its hyper-connected, style-savvy audience, the region fits squarely into Jacquemus’s strategy, not just as a market, but as a flagship market.

The transparency equation: Do good or get cancelled

Opaque supply chains can damage a brand’s reputation, especially with how ‘What Fuels Fashion‘ shed light on when they are used as a way to ‘‘mask a lack of decarbonisation progress with vague, insufficient targets and progress’’.

The fast fashion sector has offered plenty of cautionary examples in recent years. Yet, few are talking about how supply chain transparency isn’t just a compliance box to tick, it’s a real business opportunity, especially for luxury brands aiming to win the trust and prove their meaning to the next generation of buyers in Gen Z.

According to Kantar and Altiant’s dataset, in the UAE data 83 per cent of Gen Z HNWI are willing to spend time and money on brands that do good. 81 per cent of this audience actively research a brand’s social and environmental impact before making a purchase.

Luxury’s traditional opacity — the secrecy around sourcing, labour, and emissions — simply doesn’t cut it anymore. Gen Z demands to know all, not just the marketing spiel, but the hard facts.

So what’s a marketer supposed to do with all insight? After all, decisions about opening up value chains usually happen at the board level. Though, that doesn’t mean marketers have no role. In fact, there are plenty of ways transparency can come to life on the ground.

In the UAE market. Chalhoub Group’s “Unity for Change” initiative, isn’t just a slogan, it’s a blueprint for how transparency can be embedded into local market strategies. If you’re remit is global, then learnings can be taken from Stella McCartney transformation of transparency as a cost into a brand asset.

The Stella McCartney brand may be best known for its campaign with Eva Mendes, however this article is interested in the brands innovation of an Environmental Profit & Loss (EP&L) report, which offers a perspective into what could be possible for brands on the road to true transparency. Because today, storytelling isn’t just about what brands say it’s about what they’re willing to show.

For Gen Z, transparency isn’t a ‘nice to have’ its a commercial imperative. In fact, 37 per cent of luxury-purchasing Gen Z’s in the UAE strongly agree that they would only engage with brands demonstrating visible sustainability initiatives.

Therefore, the young buyers in the sector don’t ask, but require luxury brands to be transparent in not just communicating Scope 1 impact, but 2 and 3.

So what should brands do to better for Gen Z?

Here’s the key executive summary points for luxury brands with ambitions in the UAE market:

- Drop the status symbols. Replace them with stories, experiences and emotions.

- Localise your relevance. Ramadan campaigns, regional influencers, and cultural fluency aren’t “extras”, they’re essentials.

- Make your impact traceable. Supply chains can no longer be locked vaults; they need to be open books.

- Design for the feed. Instagrammable aesthetics still matter, but only when paired with meaningful substance.

Luxury is no longer confined to glass cases; it thrives in social feeds and online validation. Gen Z doesn’t want to be sold a dream — they want to co-create it. In a region where influence spreads faster than budgets, relevance is earned through meaning, not profit.

The old formula of status and scarcity no longer works. Gen Z expects brands to be transparent, personalized, and brands to come into their worlds.

This shift is already underway in the UAE and the luxury brands with foresight, continually scanning the horizon for what Gen Z wants and needs will find the oasis, while those refusing to change and embrace this generation of purposeful disruptors will be left deserted in the sands of the Rub’ al Khali.

Contributors:

Hakan Nurakin, Client Manager, Kantar

Richard Williams, Sales Consultant, Programme Design, Kantar

Wensi Li, Associate Research Manager, Kantar