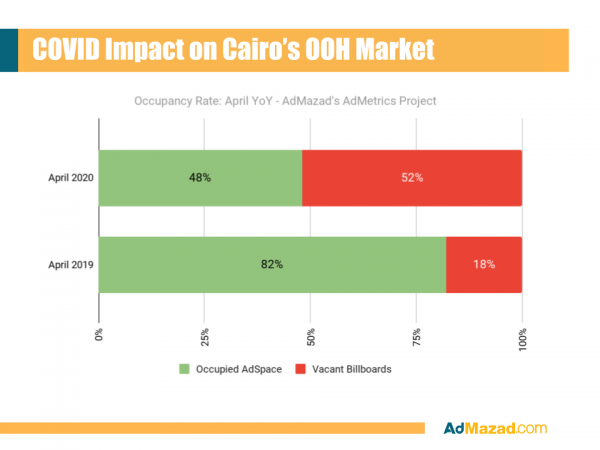

AdMazad, the data-driven solution provider for out-of-home (OOH) advertising, realized a 100% increase in empty large billboards across Greater Cairo in the first week of April 2020, reflective of the spending sentiment of multinationals and large national companies during the COVID-19-induced #StayAtHome regulations. The company specializes in analyzing real-life data and outdoor media consumption to help advertisers make better decisions on OOH ad placements.

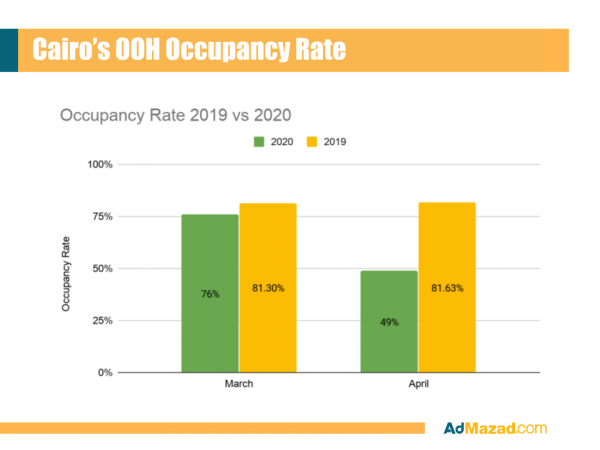

In its most recent study, Egypt-based AdMazad analyzed over 1,900 large billboards across Greater Cairo throughout the months of March and April 2020, examining whether they are vacant or not, and how much traffic can be found around them.

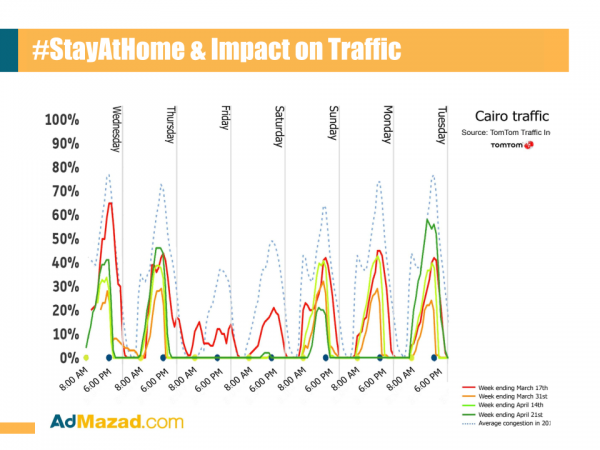

“The market took a huge hit in April,” AdMazad Founder Assem Memon says. “Our AdMetrics noted a 45% decrease in Cairo’s traffic starting the third week of March, although traffic drew very close to normal levels as of the week before Ramadan. The stay at home regulations and COVID anxiety, has resulted in a significant increase of Cost of Impression of all Outdoor Advertising Thousand Views CPM rates of OOH. ”

The study showed that the only sector that actually increased its presence in OOH advertising placements was the Healthcare sector, in which the number of billboards increased by 70% as a result of heightened expenditure by pharmacies and insurance companies. However, these had already been planned in late 2019.

The real estate industry made up only 27% of April’s billboard advertising, compared to 43% a year before, and utilizing over 200 fewer billboards. FMCG advertising dropped from 10% to just over 4% in the same period, while banks decreased from 4.5% to 2.1%.

Despite the coronavirus being probably the most popular topic today, the advertisements that are currently placed do not focus on COVID-19-related issues.

“Advertisers using OOH in April mostly kept their messages from March, and very few had COVID-19-specific messages,” Memon adds. “In the run to Ramadan, we have seen some COVID-19 messages from charities, encouraging people to direct Zakat to Healthcare support. Yet, overall there has been very limited corporate OOH expenditure or creative work incorporating COVID-19 awareness.”

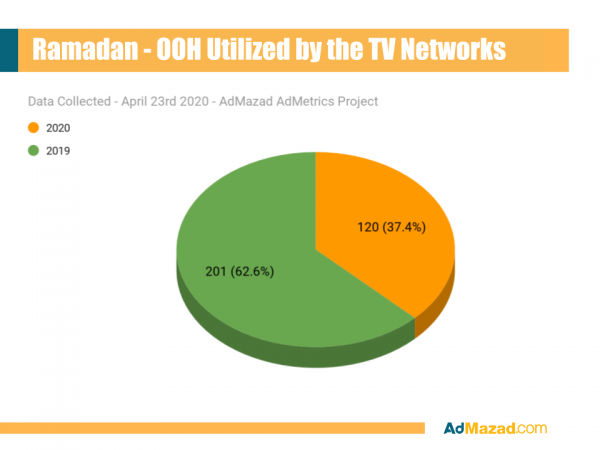

As every year, OOH expenditure increases during Ramadan; this year, the rise was driven exclusively by media companies and TV Channels. That said, when comparing with 2019, the Ramadan 2019 Season saw a decline by 40% from 299 billboards utilized in 2019. One major broadcast network decided to not use billboards during that time for the first time in five years. OOH campaign sizes from local TV channels declined 20% on average, with the overall number of occupied billboards declining to 120 from 201 in 2019.

“With the return of traffic, we should expect a slow and steady recovery of OOH advertising by June 2020. However, it will still be significantly underperforming 2019-levels,” Memon explains. “Real Estate typically owns 40%+ of the billboard market share; hence, no immediate full recovery should be expected until late into the second or third quarter of this year.”

It is expected in the short-term that advertisements will tackle companies’ readiness to embrace the impact on the market and support the “new normal” dictated by the coronavirus.

AdMazad is expecting to see FMCGs and e-commerce platforms to drive recovery, in an attempt to direct consumer expenditure to their products and platforms. E-commerce platforms in particular are still adjusting their operations in order to cope with the increased demand.