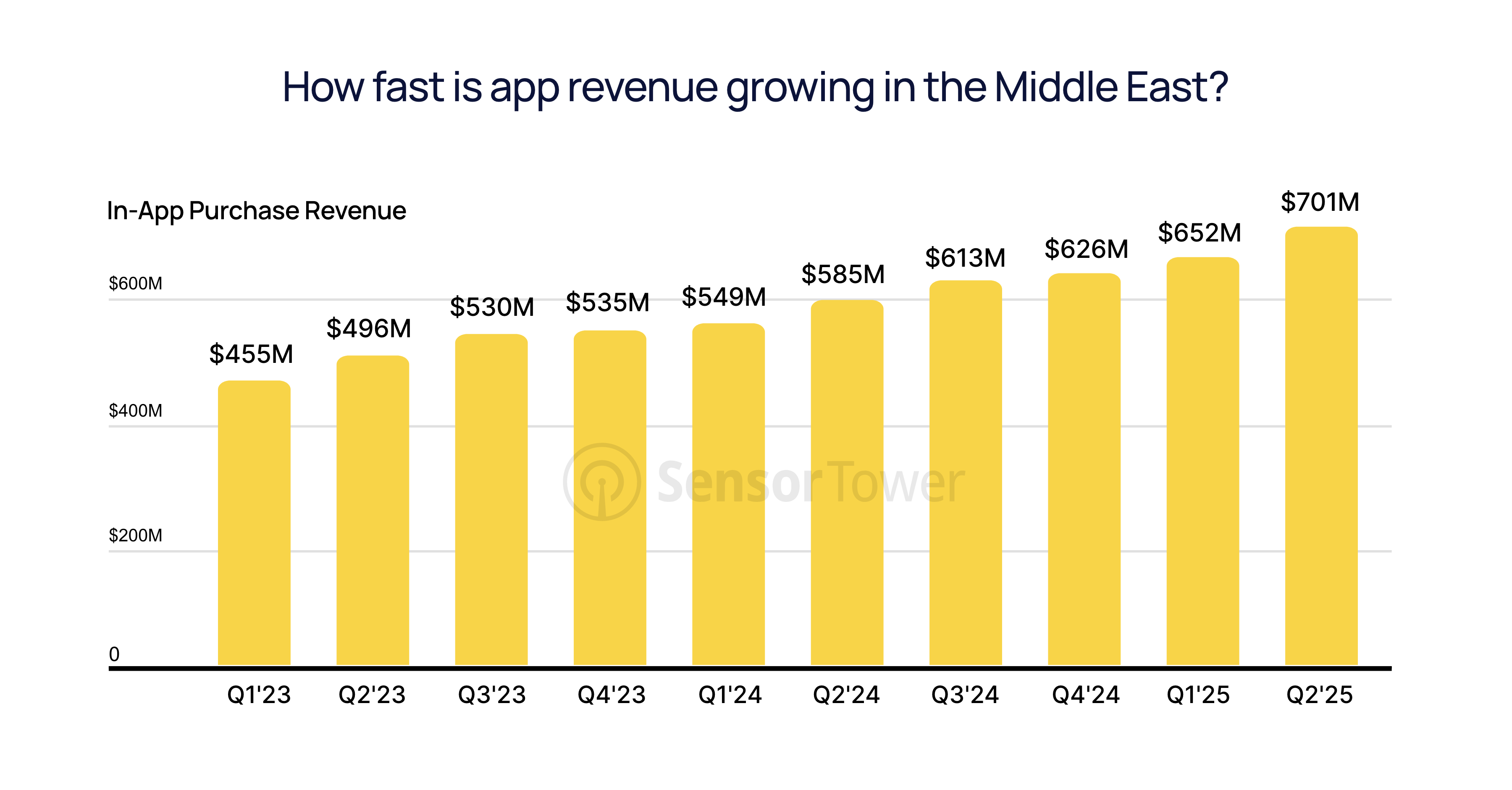

The Middle East mobile app economy is pulling ahead of global benchmarks, and the gap is widening.

While worldwide app downloads grew just 0.5 per cent year-over-year in the second quarter of 2025 (Q2 2025), the GCC region surged ahead at 2.6 per cent.

In-app purchases reached $700m, up 20 per cent year-over-year, with the UAE leading revenue growth at 26 per cent. Time spent in apps crossed 20 billion hours in the first half of 2025.

Behind this outperformance is a fundamental shift in how marketing teams operate. Artificial intelligence (AI) is in production across creative workflows. Budgets move on evidence rather than discounts. User acquisition (UA) remains the engine, while brand and retention amplify results.

According to The 2025 Middle East App Growth Report by Bidease and Sensor Tower, which surveyed 425 app growth practitioners across the region, the playbook for 2026 looks radically different than 18 months ago.

UA stays central; Brand and retention support scale

User acquisition remains the foundation, with 56 per cent of marketers planning to increase UA spend and 51 per cent boosting retargeting budgets.

Teams are coupling UA with brand (67 per cent increasing investment) and retention (41 per cent allocating more budget). The strategy is integrated: brand builds long-term value, while retention extends the value of every acquired user.

When asked what drives increased investment, 39 per cent cite stronger creative performance and 38 per cent point to better audience targeting. Lower cost per acquisition (CPAs) rank last at just 5 per cent.

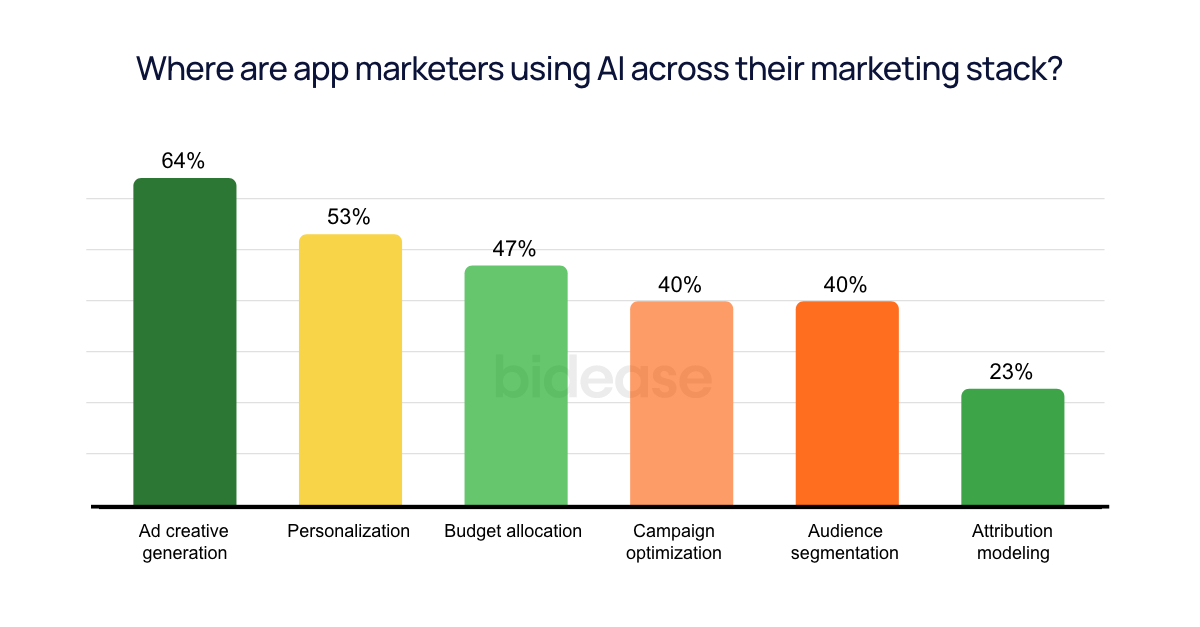

AI already in production

Among marketers surveyed, 64 per cent use AI for ad creative generation, 53 per cent for personalisation, 47 per cent for budget allocation, and 40 per cent for campaign optimisation.

The impact shows in creative velocity: 46 per cent refresh creatives weekly and 32 per cent multiple times per week, enabled by creative automation (60 per cent) and generative AI tools (48 per cent).

“User acquisition remains the engine. Scale comes from creative rigor, AI-powered optimisation, and faster feedback loops from test to budget,” said Shy Rahimi, Managing Director of MENA at Bidease.

Regional dynamics shape execution

Seasonality is shifting, with 61 per cent of marketers reporting new seasonal windows emerging.

According to Sensor Tower, shopping app demand spikes more than 30 per cent around Ramadan and Black Friday. Finance app activity follows salary cycles, peaking at month-end in Saudi Arabia with different patterns in the UAE.

Growth remains strong in key categories. Finance and Food & Dining each grew downloads over 30 per cent year-over-year in H1 2025, while Software IAP revenue climbed 77 per cent on AI-driven apps.

Competition is intensifying, with 52 per cent citing saturation in KSA and UAE as a top challenge. Global entrants including Temu and SHEIN are expanding, while built-in-region shopping apps hold share in Saudi Arabia and gain ground in the UAE.

The path forward

Despite strong programmatic adoption at 80 per cent, most teams concentrate roughly 70 per cent of spend across four or five major platforms.

“The majority of time spent among Middle East customers is in the open app economy, but 70 per cent of budgets are spent on four or five apps,” Rahimi noted. “Teams that add quality inventory beyond the majors gain incremental reach, cleaner signal, and a compounding advantage in 2026.”

The combination of strong UA fundamentals, faster creative iteration, and clearer measurement sits behind regional outperformance.

As stakes rise in the region’s app economy, the teams who win will be those who move budget on evidence, diversify efficiently, and keep testing ready for the next change.

Click here to read the full 2025 Middle East App Growth Report.