Destination marketers take note: Traveller values, personalities, preferences and budges from across 12 key global markets have been revealed in a new FutureTravel White Paper.

The study has analysed more than 280,000 in-market survey responses, aimed at providing a strategic blueprint for marketers eager to navigate shifting consumer expectations ahead of upcoming peak seasons such as winter and year-end holidays.

The white paper highlights how travellers today are more personal, purposeful, and digitally connected than ever before. While motivations vary by region, the survey underscores three powerful drivers: the pull of family reconnection, the lure of adventure, and the appeal of wellness and cultural immersion.

Key findings on traveller behaviour and preferences

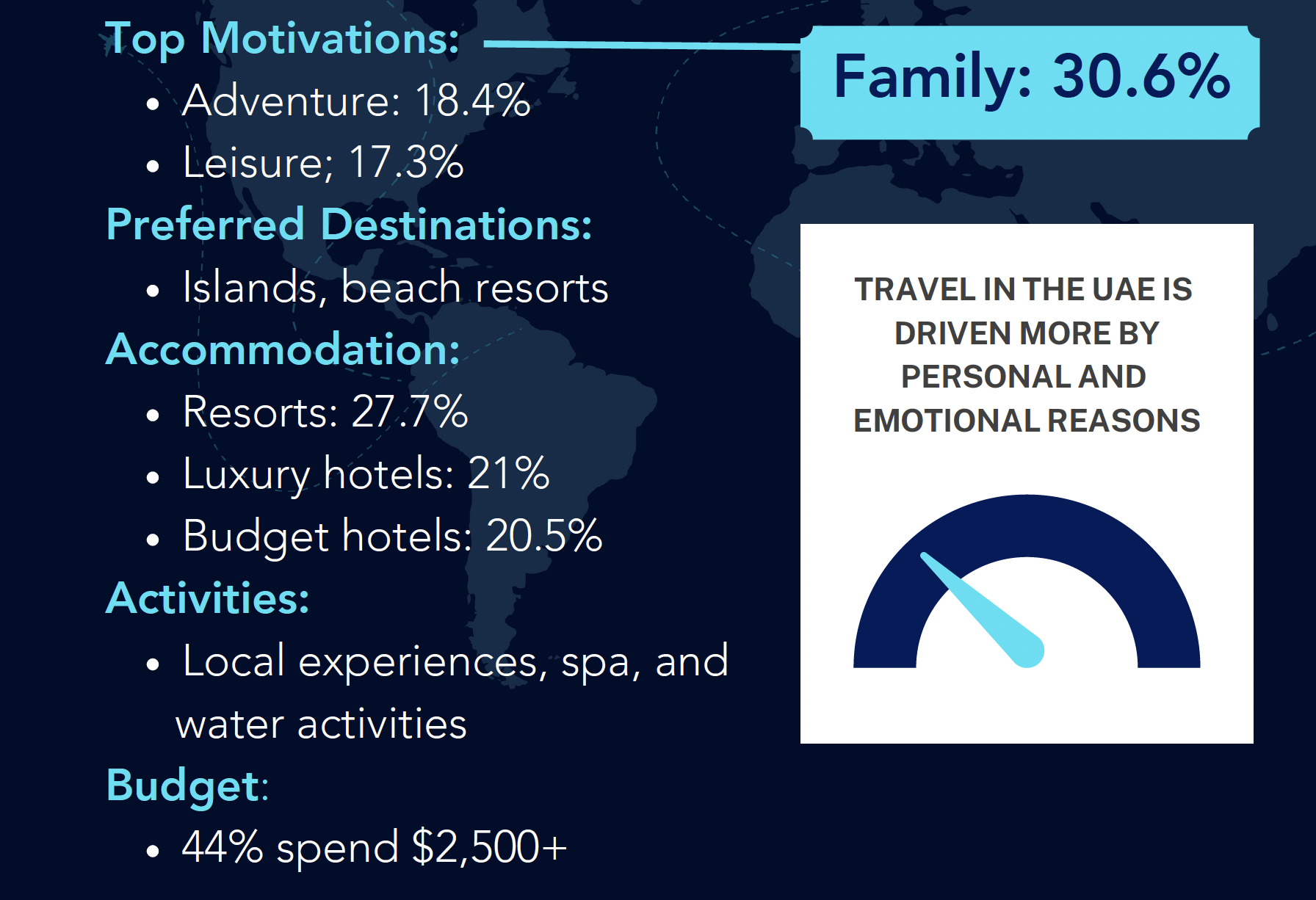

Notably, while many respondents prefer travel budgets under $2,500, high-value segments willing to spend $5,000 or more remain strong in markets such as the UAE, Turkey, and the UK. In the UAE, specifically, 44 per cent of the respondents stated that they spend more than $2,500, fuelling strong demand for luxury and concierge-style services.

The research also found a growing preference for longer vacations – more than eight days – pointing to the demand for immersive, experience-led travel. This trend represents a key opportunity for destination marketing organisations, airlines, hotels and online travel agencies to bundle extended-stay packages and promote richer itineraries.

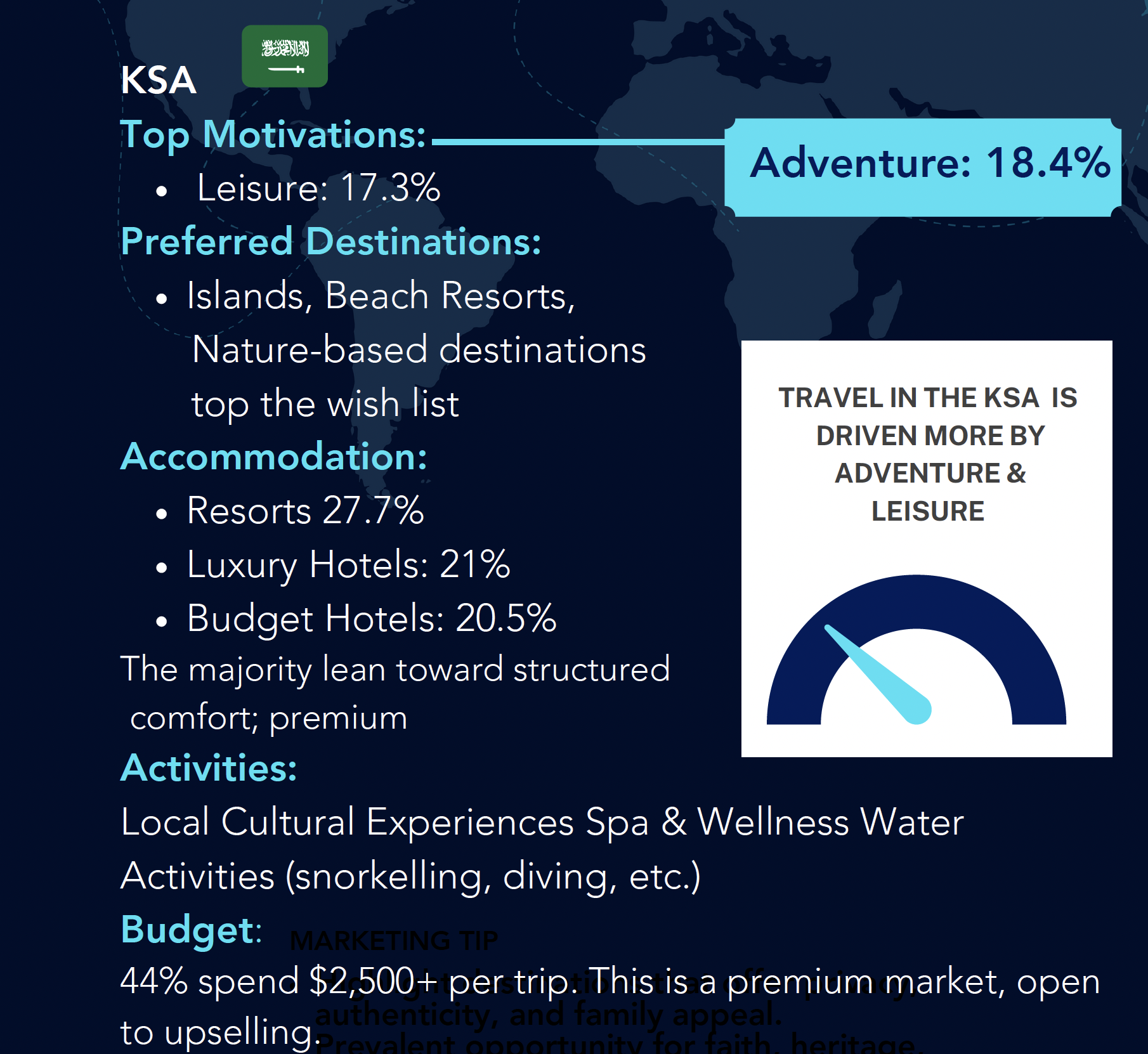

In terms of destinations, islands, beach resorts and historical sites dominate preferences, offering marketers clear direction in tailoring campaigns.

In terms of destinations, islands, beach resorts and historical sites dominate preferences, offering marketers clear direction in tailoring campaigns.

Accommodation choices reveal a split personality in global travel; luxury and resort experiences appeal strongly to affluent audiences, while budget-conscious travellers lean toward economical hotels, Airbnbs, and camping options.

“Futuretech’s 2025 FutureTravel White Paper is a timely tool for marketers preparing for the next wave of seasonal travel demand; one that emphasises precision, emotion, and technology-powered performance,” said Puja Pannum, Managing Director, Futuretech MENA.

“Our white paper shows that marketers who connect authentically to what travellers are seeking, whether it’s family togetherness, cultural rediscovery, or personal wellness, will see the highest impact,” Pannum added.

For marketers across the Middle East and beyond, the findings carry significant implications. In the UAE, for example, travellers are increasingly motivated by leisure and family-driven experiences, with a strong appetite for premium travel.

In Saudi Arabia, the market shows a unique blend of cultural discovery and luxury-seeking behaviour. Meanwhile, markets such as France and Italy reflect a more budget-conscious traveller, signalling the importance of flexible offers and value-led storytelling.

In Saudi Arabia, the market shows a unique blend of cultural discovery and luxury-seeking behaviour. Meanwhile, markets such as France and Italy reflect a more budget-conscious traveller, signalling the importance of flexible offers and value-led storytelling.

The white paper concludes with a clear message: the global traveller is no longer generic. They demand personalised, segmented, and emotion-driven engagement.

For brands in the travel ecosystem, from airlines to DMOs, the opportunity lies in using insights like these to connect meaningfully and drive business outcomes.