In the first six months of 2025, Chinese e-commerce applications accounted for 73 per cent of all user acquisition (UA) ad spend in the UAE, according to the annual State of eCommerce Mobile Marketing report recently released by AppsFlyer.

While further behind, France at 13 per cent and India at 8 per cent of UA spend in the UAE are also fast emerging as significant challengers, driven by targeted campaigns and expat-focused strategies.

The report highlights the intensifying competition overseas brands pose to local e-commerce retailers, which saw their own UA ad spend shrink.

According to experts, this likely reflects a mix of budget reallocations, mounting competitive pressure and market consolidation. AppsFlyer analysts note that home-grown players still have an opportunity to grow, provided they adopt clearer strategies and embrace performance-driven, localised campaigns.

Sue Azari, Industry Lead – eCommerce, AppsFlyer, said, “Chinese apps have long been seeking growth outside their home market, and with tariffs and global trade headwinds pushing them to diversify, the UAE has been a natural fit given its premium audience and digital maturity.”

Azari added, “At the same time, French brands are tapping into premium iOS users here, while Indian advertisers likely see the UAE’s significant South Asian expat base as an affordable, yet highly engaged segment.”

UA spend dips overall despite strong early-year performance

Despite the UAE’s advanced mobile ecosystem, with smartphone penetration at 97 per cent and average daily mobile internet use exceeding four hours, UA ad spending by e-commerce apps declined in H1 2025.

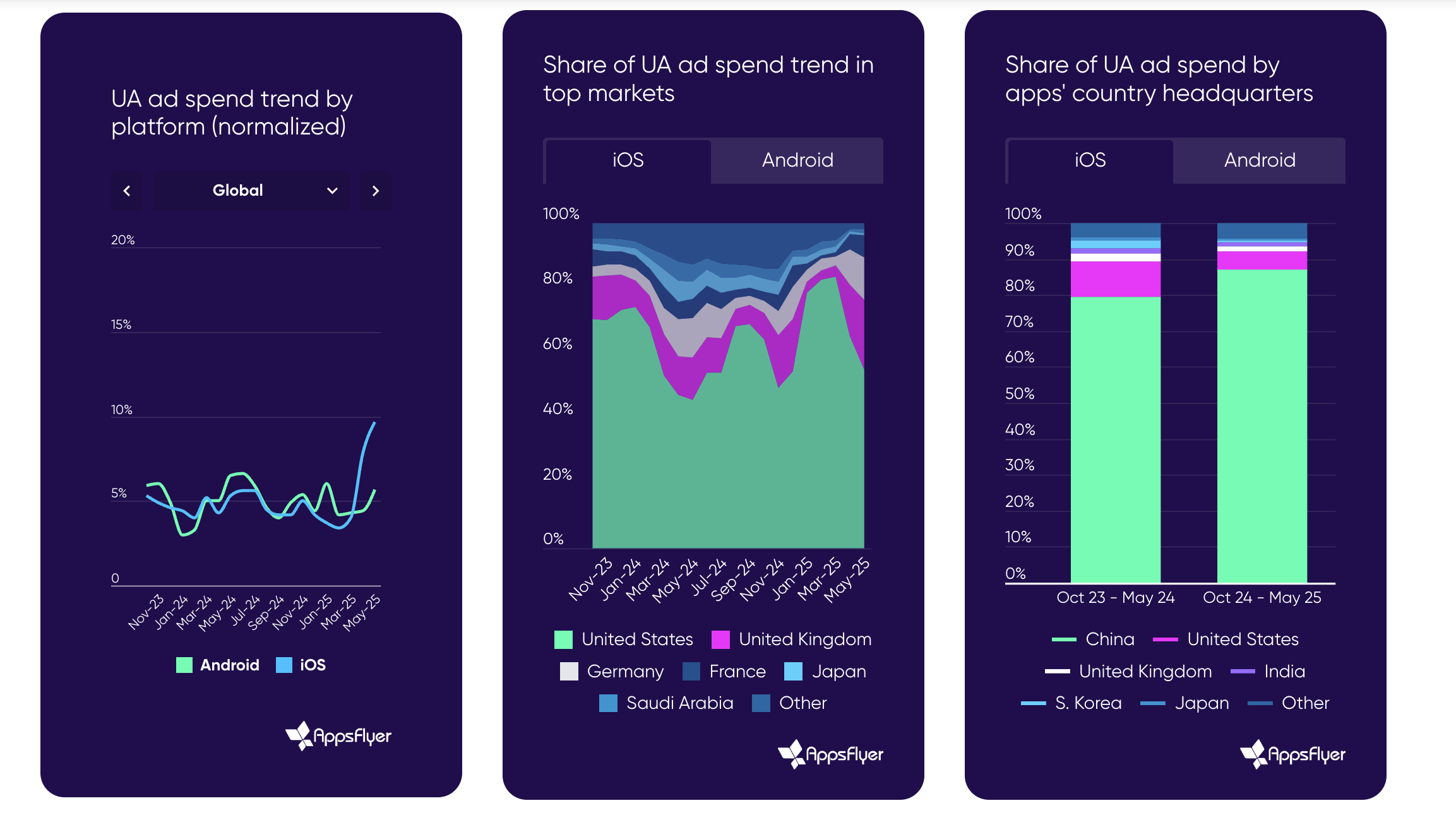

Android UA spend fell 21 per cent compared to the same period in 2024, while iOS spending was down just 6 per cent, reflecting its relative resilience.

Yet, H1 2025 still delivered the largest half-year remarketing spend to date, with Q1 alone tripling Q1 2024 levels — a clear sign of the impact of seasonal spikes during Ramadan and major retail events.

Azari said, “Marketers should take note of the pronounced peaks in Q1 tied to Ramadan and plan their upcoming campaigns accordingly, while building in remarketing strategies to sustain engagement beyond holiday periods.”

She added, “The decline in Android UA spend could also present opportunities for savvy brands to capture lower-cost inventory while still reaching a vast user base.”

With Android remarketing campaigns tripling late last year and iOS installs accelerating, the UAE remains a dynamic and competitive market for mobile commerce.

“Advertisers who balance premium iOS strategies with cost-effective Android engagement, and adapt budgets around seasonal patterns, stand the best chance of standing out in a crowded field,” Azari added.

iOS shows breakout growth and lower fraud rates

The report underscores how iOS is entering a breakout phase in the UAE.

By the end of this year, Android app installs are projected to grow by 713 per cent since 2017, while iOS is surging to over 1,383 per cent over the same period, with installs expected to more than double year-on-year in 2025.

iOS has also seen a marked improvement in fraud prevention, with fraud rates dropping 63 per cent year-on-year in H1 2025.

By contrast Android’s fraud rate jumped 234 per cent in the same period. This suggests iOS is becoming an increasingly attractive and safer, channel for marketers, even as Android remains critical for scale.